Impact Of China's Rare Earth Restrictions On Tesla's Optimus Robot Project

Table of Contents

China's Dominance in Rare Earth Mining and Refining

China's dominance in the rare earth market isn't merely significant; it's practically absolute. This control extends from mining to refining, giving them unparalleled leverage over the global supply chain. This dominance directly impacts Tesla's Optimus robot project, raising concerns about its future viability.

The Critical Role of Rare Earths in Robotics

Rare earth elements, specifically neodymium and dysprosium, are indispensable for the powerful and efficient motors, sensors, and actuators that form the backbone of advanced robots like Optimus. These elements are crucial for creating high-performance permanent magnets, essential for optimal motor performance and the precise, powerful movements required of a humanoid robot.

- Neodymium magnets in Optimus's motors ensure efficient energy conversion, enabling smooth and powerful movements.

- Dysprosium enhances the temperature resistance of these magnets, ensuring reliable performance even under intense operational conditions.

- Actuators rely on rare earth magnets for precision control of the robot's limbs and joints.

The lack of readily available alternatives to these Chinese-dominated rare earths poses a significant risk to Tesla's project and the broader robotics industry.

China's Export Controls and Their Potential Impact

China's export policies regarding rare earth minerals are a source of significant concern. While not currently imposing outright bans, subtle shifts in quotas, increased processing fees, and targeted restrictions towards specific nations could severely impact the availability and affordability of these crucial resources for companies like Tesla. This creates a substantial geopolitical risk, escalating the potential for trade wars and supply chain disruptions.

- Scenario 1: Price Increases: Even modest increases in rare earth prices can significantly impact Tesla's manufacturing costs, potentially affecting the robot's final price and its competitiveness in the market.

- Scenario 2: Supply Disruptions: More severe export restrictions or unexpected geopolitical events could lead to complete supply chain disruptions, halting Optimus production and delaying its market launch indefinitely.

- Scenario 3: Targeted Sanctions: China could impose targeted sanctions on specific countries, further complicating the already fragile global supply chain for rare earths.

Tesla's Supply Chain Vulnerability and Diversification Efforts

Tesla's current reliance on Chinese suppliers for rare earth materials or components containing them represents a significant vulnerability. This dependence exposes the company to potential supply chain disruptions and price volatility stemming from China's policies.

Current Reliance on Chinese Suppliers

Tesla, like many tech companies, currently sources a significant portion of its rare earth needs from Chinese suppliers. This reliance is particularly pronounced in components requiring high-performance neodymium-iron-boron (NdFeB) magnets.

- Motor components: A substantial portion of the motors used in Tesla's vehicles and potentially Optimus are likely reliant on Chinese-sourced rare earth magnets.

- Sensor components: Sensors utilized for navigation and environmental awareness may also incorporate rare earth materials from Chinese suppliers.

- Actuator components: The precision movements of Optimus's limbs depend on actuators incorporating rare earth magnets.

Strategies for Diversifying Sourcing

To mitigate the risks associated with its current supply chain vulnerability, Tesla must actively pursue diversification strategies. These strategies involve a multifaceted approach requiring significant investment and long-term planning.

- Investing in alternative mining and processing technologies: This is a long-term strategy, but essential for reducing dependence on existing sources.

- Exploring new sources of supply: Countries like Australia, the United States, and Canada are actively developing their rare earth mining and processing capacities. Securing supply agreements with these nations is crucial.

- Developing substitute materials: Research into alternative materials that can replace rare earths in key applications is vital for long-term supply chain security. This may involve investing in research and development of alternative magnet technologies.

- Recycling and reuse: Implementing robust recycling programs for end-of-life products containing rare earths is essential for reducing reliance on new mining operations.

- Vertical integration: Tesla might consider acquiring or investing in companies throughout the rare earth supply chain, gaining more control over sourcing and pricing.

Examples of other companies successfully diversifying their rare earth supply chains can provide valuable insights and strategies for Tesla to emulate.

The Broader Implications for the Robotics Industry

China's control over rare earths has far-reaching implications beyond Tesla's Optimus project. It casts a long shadow over the entire robotics industry, potentially hindering innovation and accelerating geopolitical tensions.

Impact on Innovation and Development

Restricted access to rare earth elements could significantly impede innovation and development in the global robotics industry. The high cost and uncertainty of supply could stifle investment in research and development, potentially delaying or halting advancements in robotics technology.

- This could disproportionately impact smaller robotics companies with fewer resources to diversify their supply chains.

- The potential slowdown in technological advancement could hinder the progress of various industries reliant on robotics, including manufacturing, healthcare, and logistics.

- A technological arms race focused on developing rare earth alternatives is likely to emerge, driving significant investment in materials science and engineering.

Geopolitical and Economic Ramifications

The dependence on China for rare earths creates significant geopolitical instability. It exacerbates existing trade tensions and increases the risk of economic sanctions and retaliatory measures.

- The potential for trade disputes and escalating tensions between nations highlights the critical need for international cooperation in addressing this issue.

- Establishing collaborative efforts to diversify rare earth production and develop sustainable sourcing methods would mitigate geopolitical risks and promote global economic stability.

Conclusion

China's dominance in rare earth production poses a significant threat to Tesla's Optimus robot project and the wider robotics industry. The potential for supply chain disruptions and price volatility necessitates proactive measures from Tesla and other companies. Diversifying sourcing, investing in alternative materials, and promoting international cooperation are crucial steps to mitigate the risks associated with China's rare earth policies. Tesla must actively diversify its supply chain and invest in alternative solutions to maintain its competitive edge and ensure the successful launch of its ambitious Optimus robot. Staying informed about the evolving landscape of rare earth minerals and their impact on technological advancements is crucial for anyone invested in the future of robotics and automation. Understanding the implications of China's rare earth policies is key to navigating this complex and critical challenge for the future of robotics.

Featured Posts

-

The Destruction Of Pope Francis Fishermans Ring Tradition And Symbolism

Apr 24, 2025

The Destruction Of Pope Francis Fishermans Ring Tradition And Symbolism

Apr 24, 2025 -

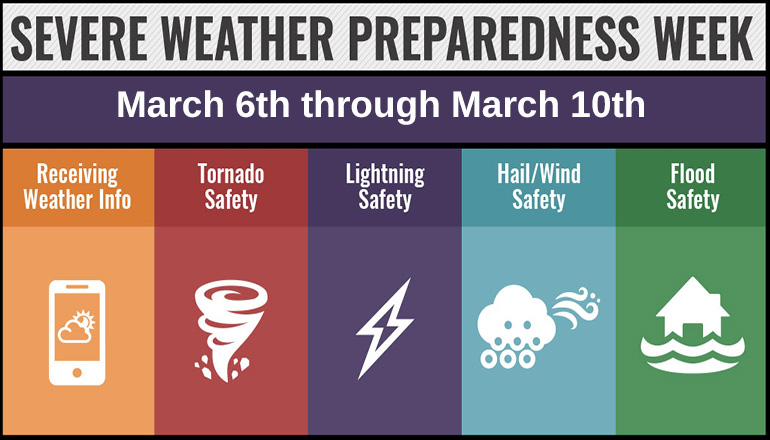

Severe Weather Preparedness Underfunded Examining The Risks During Tornado Season

Apr 24, 2025

Severe Weather Preparedness Underfunded Examining The Risks During Tornado Season

Apr 24, 2025 -

Trump Reassures Markets Stock Futures Jump After Powell Comments

Apr 24, 2025

Trump Reassures Markets Stock Futures Jump After Powell Comments

Apr 24, 2025 -

Brett Goldstein On Ted Lassos Revival A Resurrected Cat

Apr 24, 2025

Brett Goldstein On Ted Lassos Revival A Resurrected Cat

Apr 24, 2025 -

The Zuckerberg Trump Dynamic How The Next Presidency Impacts Facebook

Apr 24, 2025

The Zuckerberg Trump Dynamic How The Next Presidency Impacts Facebook

Apr 24, 2025