High Stock Market Valuations: BofA's Perspective And Why Investors Shouldn't Panic

Table of Contents

BofA's Current Market Outlook and Valuation Analysis

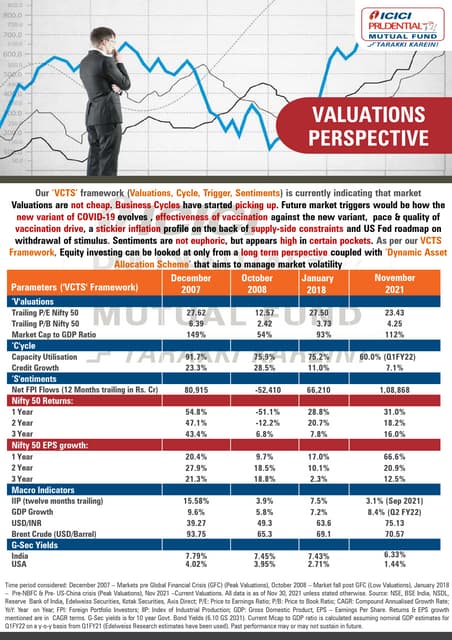

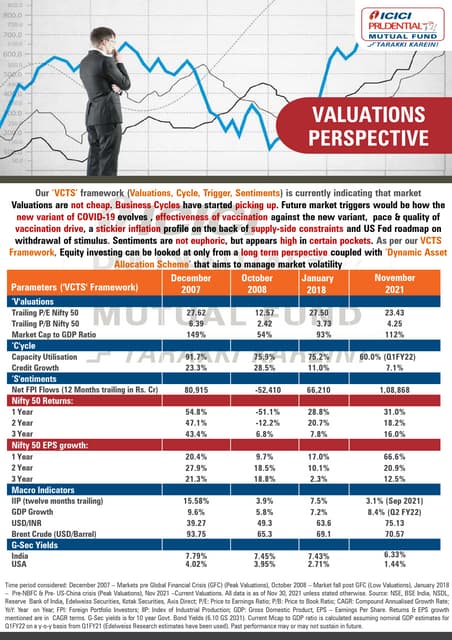

Bank of America's latest reports indicate elevated stock market valuations, reflecting concerns shared across the investment community. While specific metrics change frequently, BofA's analysis often involves examining key ratios like the price-to-earnings (P/E) ratio across various sectors and comparing them to historical averages. They might also consider other valuation metrics such as Price-to-Sales (P/S) and Price-to-Book (P/B) ratios to get a more comprehensive picture. Their methodology typically involves a blend of quantitative analysis using these metrics and qualitative assessments considering macroeconomic factors and industry trends. It's important to remember that any analysis, including BofA's, has inherent limitations; unforeseen events and shifts in market sentiment can significantly impact valuations.

- Key valuation metrics used by BofA: P/E ratio, P/S ratio, P/B ratio, dividend yield.

- BofA's assessment of current market risks: Increased interest rate volatility, potential inflation pressures, geopolitical uncertainty.

- BofA's predicted market performance (short-term and long-term): While specific predictions vary with market conditions, BofA typically provides a range of potential outcomes considering various scenarios. Their long-term outlook is usually more optimistic than the short-term forecast.

Understanding the Factors Contributing to High Valuations

Several factors contribute to the current high stock market valuations. These are complex and interconnected, making a simple explanation insufficient.

- Low interest rate environment and its impact: Historically low interest rates make borrowing cheaper for companies, boosting investment and earnings, which often translates into higher stock prices. This is a key driver pushing valuations higher.

- Strong corporate earnings and profit growth: Many companies have reported robust earnings growth in recent years, fueling investor confidence and driving up stock prices. This increased profitability supports higher valuations.

- Technological innovation and its effect on valuations: Rapid advancements in technology, particularly in sectors like artificial intelligence and cloud computing, have created high-growth opportunities, leading to premium valuations for companies in these sectors. This rapid growth attracts significant investment.

- Increased investor confidence (or lack thereof): Investor sentiment plays a significant role. Periods of high confidence tend to inflate valuations, while periods of uncertainty can lead to corrections. Currently, while there are pockets of uncertainty, overall confidence in many sectors remains relatively high.

Why Investors Shouldn't Panic Despite High Valuations

Despite the seemingly high valuations, panic selling is rarely the optimal strategy. A long-term perspective is crucial.

- Long-term historical perspective on market valuations: Historically, markets have experienced periods of high valuations followed by periods of correction. These cycles are normal, and attempting to time the market perfectly is often unsuccessful.

- Importance of a diversified investment portfolio: Diversification across asset classes (stocks, bonds, real estate, etc.) reduces risk and helps mitigate potential losses in any single sector. A diversified portfolio is crucial for managing risk associated with high valuations.

- Strategies for navigating a potentially volatile market: Strategies like dollar-cost averaging (investing a fixed amount regularly) can help reduce the impact of market volatility. Rebalancing your portfolio periodically also helps maintain your desired asset allocation.

- Identifying undervalued sectors or stocks: Even in a high-valuation market, opportunities exist. Careful research can help identify potentially undervalued companies or sectors that offer attractive risk-adjusted returns.

Alternative Investment Strategies for High-Valuation Markets

To mitigate the risks associated with high stock market valuations, investors may consider diversifying into alternative asset classes.

- Bond market analysis and potential yields: Bonds typically offer lower returns than stocks but can provide stability during market downturns. Analyzing bond yields and maturity dates is essential for effective portfolio diversification.

- Real estate investment opportunities and considerations: Real estate can be a valuable addition to a diversified portfolio, offering potential for income generation and long-term capital appreciation. However, it requires careful consideration of market conditions and property management.

- Commodity market trends and forecasts: Commodities, such as gold, oil, and agricultural products, can act as a hedge against inflation and currency fluctuations. Analyzing commodity price trends and forecasts is vital before investing.

- Diversification across asset classes: The key takeaway is to spread investments across different asset classes to reduce overall portfolio risk. A balanced portfolio can better navigate periods of high stock market valuations.

Conclusion: Navigating High Stock Market Valuations: A Balanced Approach

BofA's analysis, coupled with a broader understanding of market dynamics, shows that while high stock market valuations are a valid concern, panic selling is not the answer. A long-term investment strategy, coupled with diversification across multiple asset classes and informed decision-making, is crucial. Don't let concerns about high stock market valuations paralyze you; develop a well-informed investment plan today. Consult with a qualified financial advisor to create a personalized investment strategy tailored to your risk tolerance and financial goals. Remember, consistent, informed investment, rather than reactive panic selling, is the key to long-term success in navigating even the most challenging market conditions.

Featured Posts

-

Kuxius Solid State Power Bank Higher Cost Longer Life

Apr 28, 2025

Kuxius Solid State Power Bank Higher Cost Longer Life

Apr 28, 2025 -

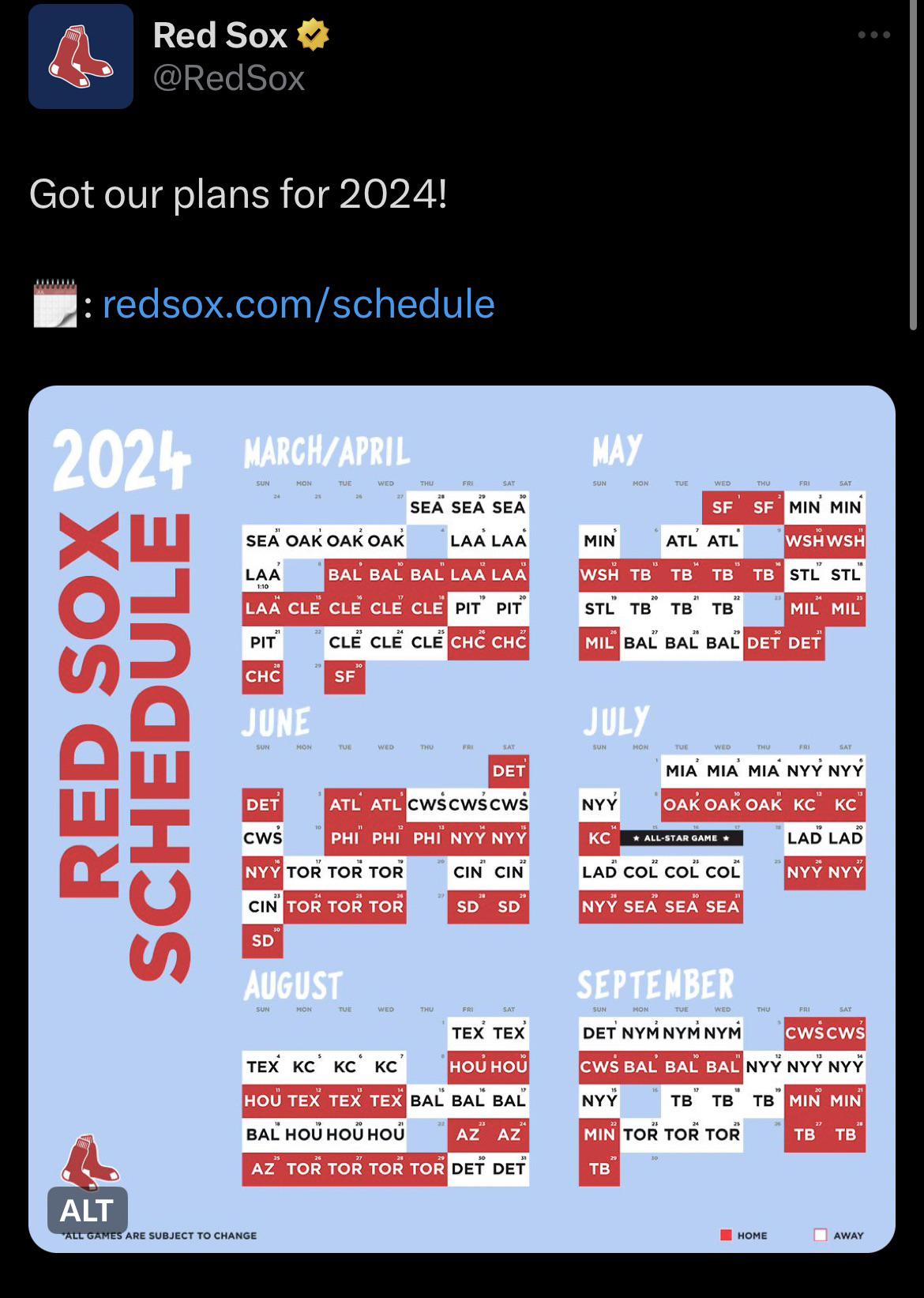

A Controversial Espn Prediction The Red Sox 2025 Outfield

Apr 28, 2025

A Controversial Espn Prediction The Red Sox 2025 Outfield

Apr 28, 2025 -

The Yankees Lineup Shuffle Aaron Judges Position And Boones Explanation

Apr 28, 2025

The Yankees Lineup Shuffle Aaron Judges Position And Boones Explanation

Apr 28, 2025 -

Twins Win 6 3 Over Mets Taking Game Two Of Series

Apr 28, 2025

Twins Win 6 3 Over Mets Taking Game Two Of Series

Apr 28, 2025 -

Aaron Judges Lineup Spot Will Boones Decision Satisfy The Star

Apr 28, 2025

Aaron Judges Lineup Spot Will Boones Decision Satisfy The Star

Apr 28, 2025