Fiscal Policy Under Conservative Leadership: Tax Cuts And Deficit Control In Canada

Table of Contents

Tax Cut Policies Under Conservative Governments

The Rationale Behind Tax Cuts: Stimulating Economic Growth

Conservative governments in Canada have often justified tax cuts using supply-side economics. This theory posits that lower taxes incentivize increased investment, job creation, and overall economic activity. By reducing the tax burden on businesses and individuals, the argument goes, they have more disposable income to invest and spend, leading to a ripple effect of economic growth.

- Intended Effects: Increased investment, higher employment rates, stimulated economic activity, and increased consumer spending.

- Specific Examples:

- The Mulroney government's reduction of the Goods and Services Tax (GST) from 9% to 7% in 1991.

- The Harper government's various income tax cuts targeting specific income brackets.

Evaluating the Effectiveness of Tax Cuts: Evidence and Analysis

The effectiveness of Conservative tax cuts in Canada remains a subject of ongoing debate. While proponents point to periods of economic growth following tax cuts, critics highlight concerns about income inequality and the impact on government revenue.

- Evidence: Analyzing economic growth rates, employment figures, and income distribution data during periods of Conservative tax cuts is crucial for a comprehensive evaluation. Some studies suggest a positive correlation between tax cuts and growth, while others find minimal or negative effects.

- Criticisms: Critics argue that tax cuts disproportionately benefit higher-income earners, exacerbating income inequality. Furthermore, reduced government revenue can limit public spending on essential services like healthcare and education.

- Distributional Effects: Examining who benefited most from specific tax cuts is essential. Did the benefits trickle down to all segments of society, or did they primarily accrue to the wealthy?

- Opposing Viewpoints: It's crucial to consider alternative viewpoints and acknowledge the complexities of economic modeling and data interpretation.

Deficit Control Measures Under Conservative Rule

Strategies for Deficit Reduction: Austerity vs. Growth-Oriented Approaches

Conservative governments have employed various strategies to control budget deficits. These often involve a mix of austerity measures (spending cuts) and initiatives aimed at stimulating economic growth to increase government revenue.

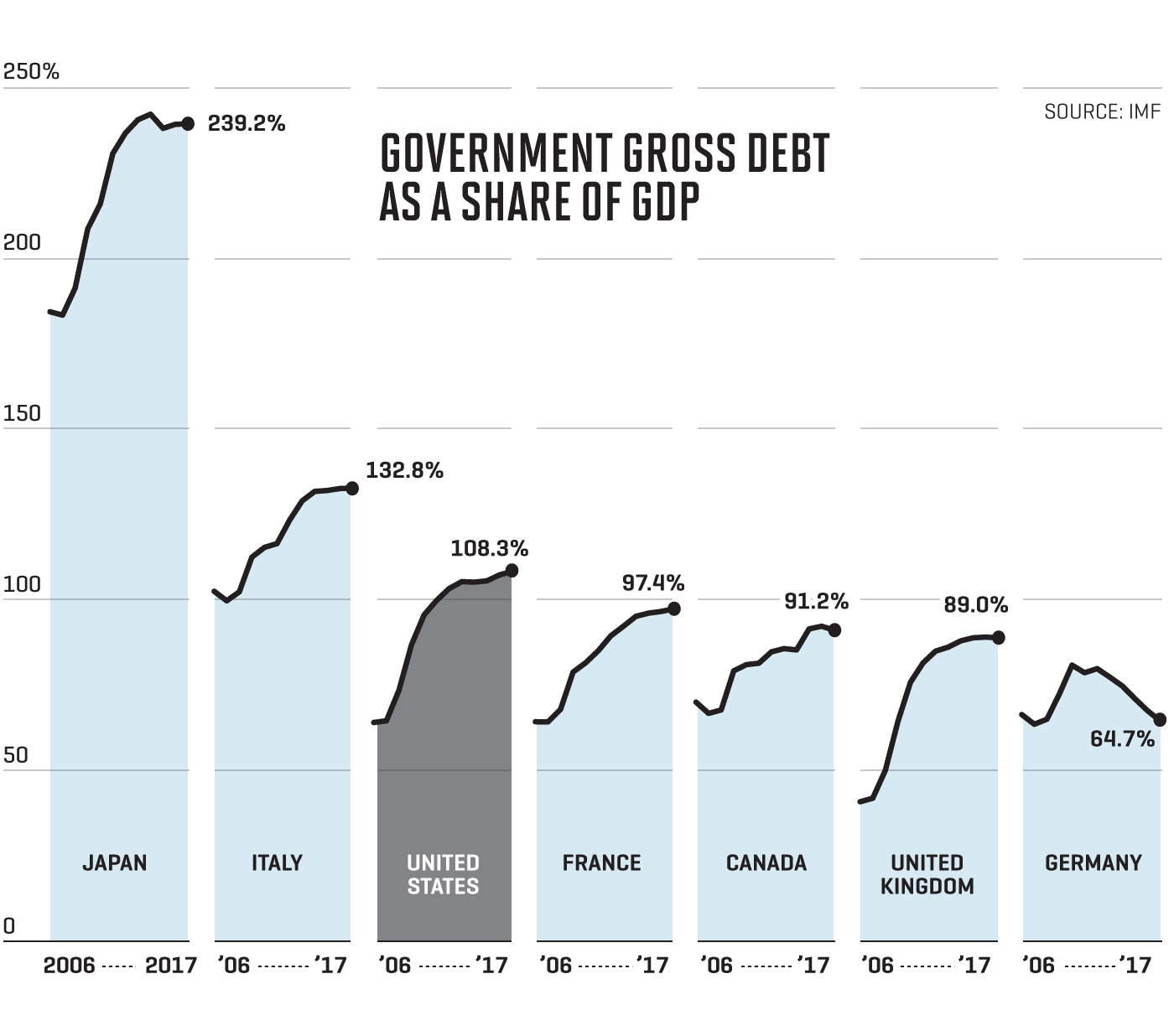

- Austerity Measures: Examples include reducing government spending on social programs, freezing public sector wages, and implementing efficiency measures within government departments.

- Growth-Oriented Approaches: These might include tax incentives for businesses, investments in infrastructure projects, and deregulation to encourage private sector investment.

- Political and Social Implications: Austerity measures often face political opposition and can have negative social consequences, such as reduced access to public services.

Assessing the Success of Deficit Reduction Efforts: Long-Term Impacts

Evaluating the long-term success of deficit reduction strategies requires analyzing several key indicators.

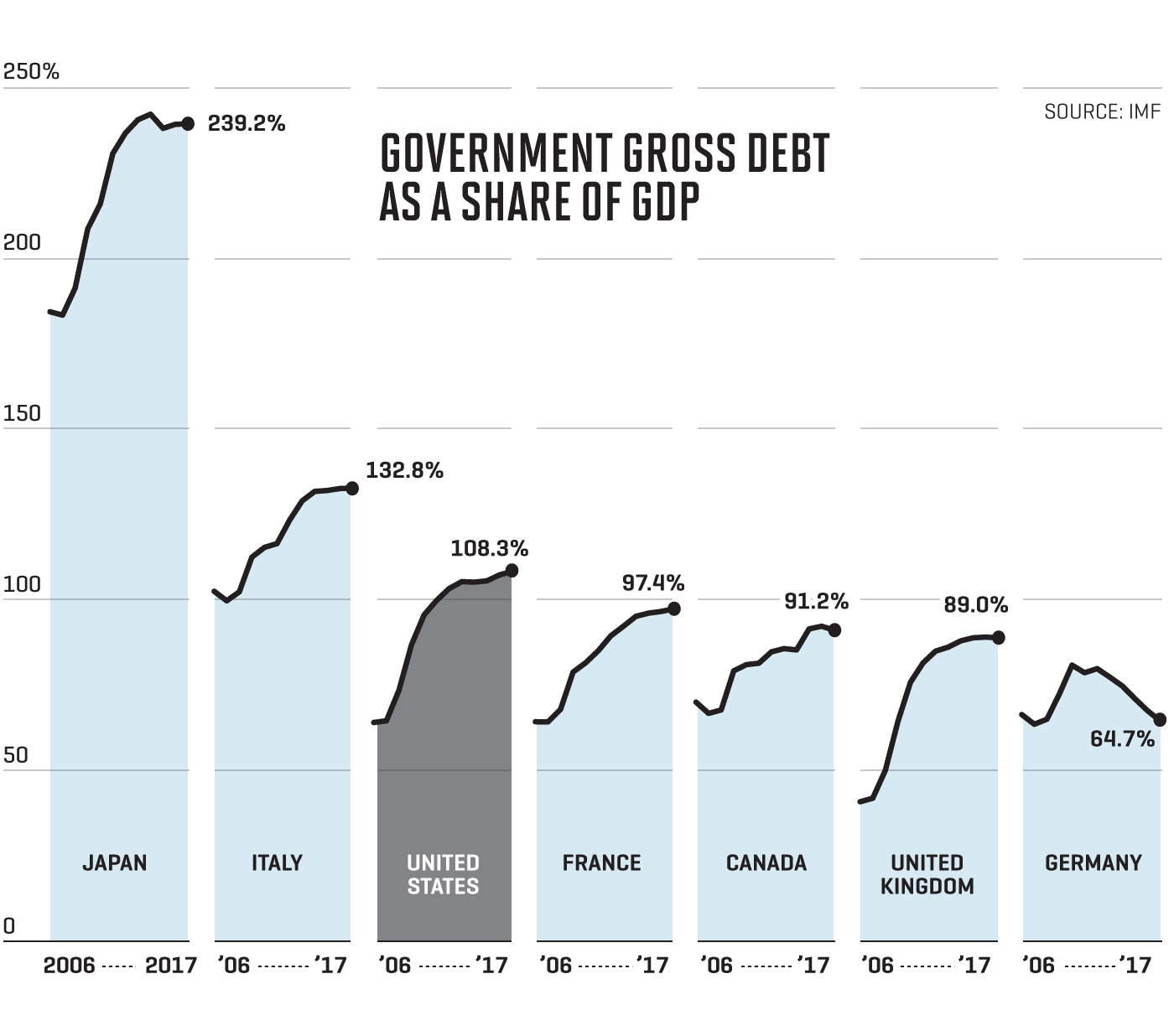

- National Debt Trends: Examining the trajectory of Canada's national debt under Conservative leadership provides valuable insights.

- Debt-to-GDP Ratios: This ratio indicates the country's ability to service its debt. A rising ratio can signal increased fiscal vulnerability.

- Sustainability of Fiscal Policies: Are the implemented policies sustainable in the long term, or do they create future fiscal challenges? Consider factors such as demographic shifts and potential economic downturns.

The Interplay Between Tax Cuts and Deficit Control

A central tension exists between implementing tax cuts (which reduce government revenue) and simultaneously aiming for deficit control (which requires reducing spending or increasing revenue). This presents a significant challenge for policymakers.

- Economic Theories: Various economic models attempt to explain the relationship between tax cuts, government revenue, and economic growth. Understanding these models is crucial for informed policymaking.

- Trade-offs: Balancing these competing goals requires difficult trade-offs. Cutting taxes might boost economic growth, but it also reduces government revenue, potentially widening the deficit. Conversely, focusing solely on deficit reduction through austerity measures might stifle economic growth.

- Examples from Canadian History: Analyzing how Canadian Conservative governments have navigated this tension provides valuable lessons. Did they prioritize tax cuts over deficit reduction, or vice versa? What were the consequences?

Fiscal Policy Under Conservative Leadership: A Retrospective and Future Outlook

This analysis reveals that the effectiveness of tax cuts and deficit control measures under Conservative governments in Canada is complex and multifaceted. While some periods saw economic growth alongside tax cuts, other instances highlight the challenges of balancing fiscal prudence with social priorities. The long-term impact on Canada's economy and society requires further in-depth study. Future Conservative administrations will likely continue to grapple with these same trade-offs.

We encourage readers to delve deeper into the complexities of Canadian fiscal policy, explore different perspectives on Conservative government economic strategies, and engage in discussions about responsible tax cuts and deficit control in Canada. Understanding Canada's economy and its governance is crucial for informed citizenship and future policy debates. Further research into specific policies, their implementation, and their long-term effects is essential for a complete understanding of Canadian fiscal policy under Conservative leadership.

Featured Posts

-

Elite Universities Facing Trump Administration Funding Cuts A Financial Response

Apr 24, 2025

Elite Universities Facing Trump Administration Funding Cuts A Financial Response

Apr 24, 2025 -

World Economic Forum New Investigation Into Klaus Schwab

Apr 24, 2025

World Economic Forum New Investigation Into Klaus Schwab

Apr 24, 2025 -

The Bold And The Beautiful April 3 2024 Liam Collapses After Major Fight With Bill Full Recap

Apr 24, 2025

The Bold And The Beautiful April 3 2024 Liam Collapses After Major Fight With Bill Full Recap

Apr 24, 2025 -

The Significance Of Destroying The Popes Ring A Look At Catholic Tradition

Apr 24, 2025

The Significance Of Destroying The Popes Ring A Look At Catholic Tradition

Apr 24, 2025 -

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 24, 2025

Understanding The Importance Of Middle Managers In Todays Workplace

Apr 24, 2025