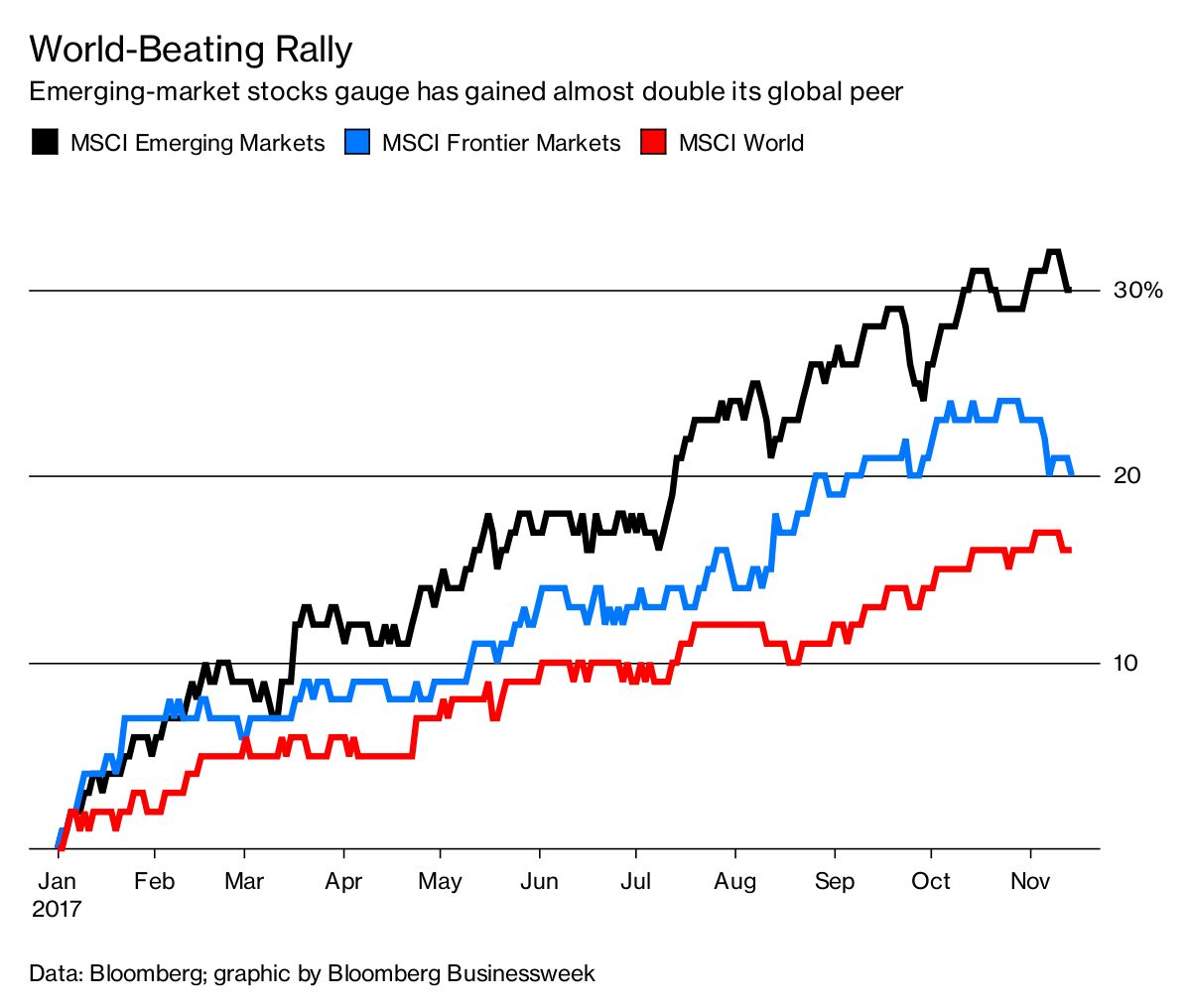

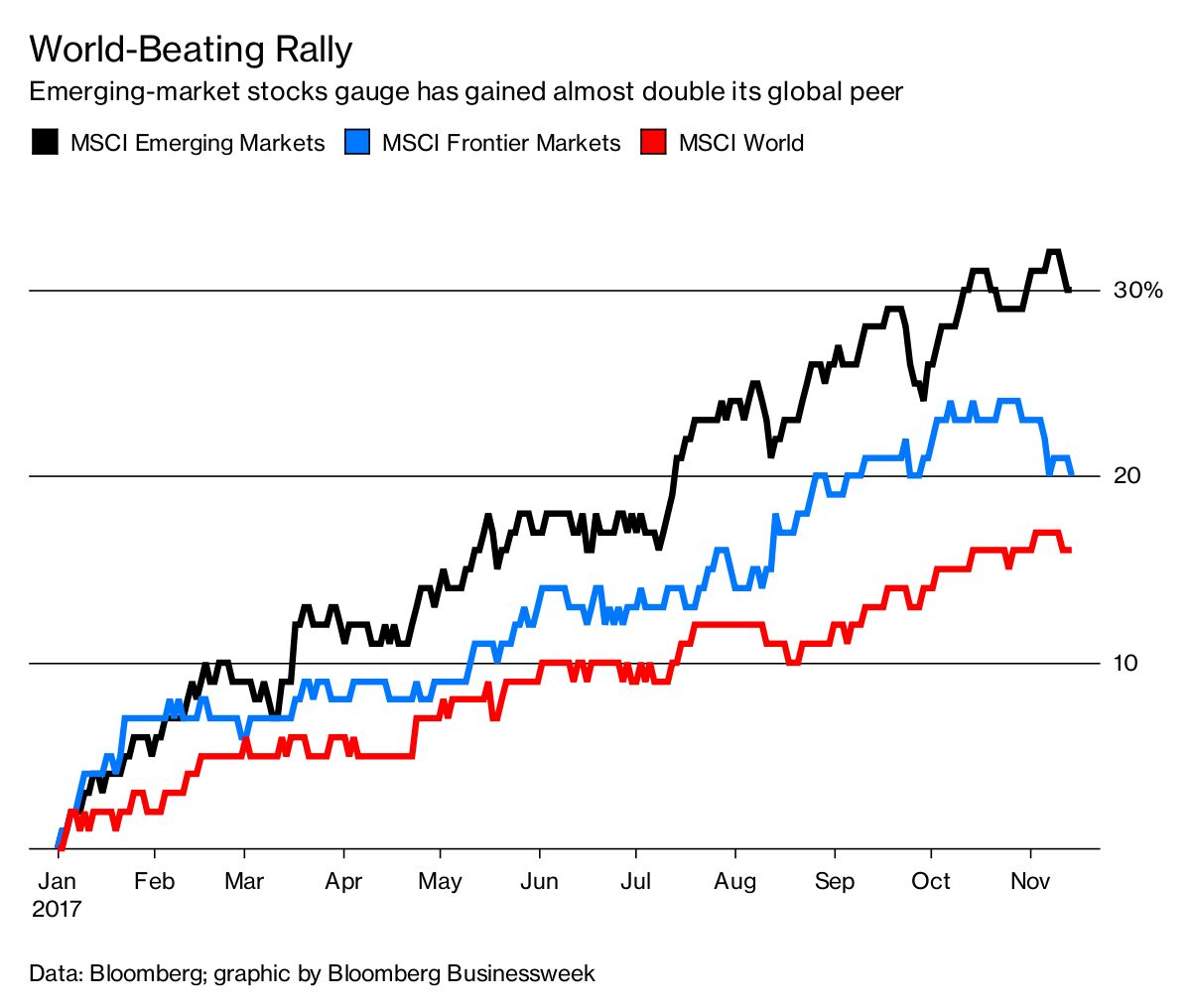

Emerging Market Stocks Outperform US: Year-to-Date Gains

Table of Contents

Factors Driving Emerging Market Stock Outperformance

Several key factors contribute to the impressive year-to-date performance of emerging market stocks. These factors highlight the potential for significant returns, but also underscore the need for careful consideration before investing.

Economic Growth in Emerging Markets

Many key emerging markets are experiencing robust economic growth, outpacing developed nations like the US.

- Higher GDP growth rates: Countries like India and several nations in Southeast Asia have consistently demonstrated higher GDP growth rates compared to the US, fueling economic expansion and creating opportunities for businesses.

- Increased consumer spending: Rising disposable incomes in many emerging markets are leading to increased consumer spending, driving demand and boosting corporate earnings.

- Government infrastructure investments: Significant government investments in infrastructure projects are further stimulating economic activity and creating long-term growth potential.

- Positive demographic trends: A large and growing young population in many emerging markets represents a significant workforce and consumer base, fueling future economic growth. For example, India's young and expanding population is a major driver of its economic growth.

Valuations and Opportunities

Emerging market stocks often present more attractive valuations compared to their US counterparts.

- Lower Price-to-Earnings ratios (P/E): Many emerging market companies trade at lower P/E ratios, suggesting they may be undervalued relative to their earnings potential.

- Higher dividend yields: Some emerging market stocks offer higher dividend yields, providing a steady income stream for investors.

- Potential for significant capital appreciation: The potential for substantial capital appreciation is high due to the significant growth prospects in these economies. This catch-up growth potential often translates to higher returns over the long term.

Diversification Benefits

Investing in emerging market stocks offers significant diversification benefits for investors.

- Reduced portfolio volatility: Because emerging markets often have a low correlation with US markets, adding exposure to them can reduce the overall volatility of a portfolio.

- Better risk-adjusted returns: Diversification can improve risk-adjusted returns, potentially leading to better overall portfolio performance.

- Protection against market downturns: When US markets experience a downturn, emerging markets may perform differently, offering a degree of insulation from overall market declines. A well-diversified portfolio reduces the overall risk profile.

Geopolitical Factors and Influence

Global events and political shifts significantly impact emerging markets.

- De-dollarization trends: The increasing adoption of alternative currencies in international trade and finance could create new opportunities for emerging markets.

- Shifts in global supply chains: The ongoing reshaping of global supply chains presents both challenges and opportunities for emerging market economies.

- Political instability and regulatory changes: Investors must remain aware of the potential risks associated with political instability and changes in regulations within specific emerging markets. This requires diligent research and risk assessment.

Risks and Considerations for Investing in Emerging Markets

While the potential rewards are considerable, investing in emerging markets also carries significant risks.

Volatility and Uncertainty

Emerging markets are inherently more volatile than established markets.

- Currency fluctuations: Significant currency fluctuations can impact returns for investors.

- Political instability: Political instability and uncertainty can create significant risks for investors.

- Regulatory risks: Changes in regulations can negatively affect the performance of companies and the overall market.

- Economic downturns: Emerging markets can be more susceptible to economic downturns than developed economies. A long-term investment horizon is crucial to navigate these cycles.

Liquidity and Accessibility

Accessing and trading emerging market stocks can present challenges.

- Lower trading volumes: Trading volumes may be lower in some emerging markets, making it more difficult to buy or sell assets quickly.

- Limited research coverage: There may be less readily available research and analysis on emerging market companies compared to US companies.

- Higher transaction costs: Transaction costs can be higher when investing in some emerging markets. Using ETFs or mutual funds can help mitigate these costs.

Due Diligence and Research

Thorough research is essential before investing in emerging markets.

- Analyze individual companies and country-specific risks: Investors should carefully analyze the financial health and prospects of individual companies and the specific risks associated with each market.

- Consult with financial advisors: Seeking professional advice from a financial advisor experienced in emerging markets is highly recommended.

Conclusion

Emerging market stocks have demonstrated a remarkable outperformance compared to US stocks year-to-date. This trend is driven by strong economic growth, attractive valuations, and the benefits of diversification. However, investors should be aware of the increased volatility and potential risks associated with these markets. The potential for long-term growth in emerging markets remains significant, but thorough research, careful risk assessment, and a long-term investment horizon are crucial. Invest in emerging market stocks today by carefully considering your risk tolerance and conducting thorough due diligence. Learn more about emerging market investments and explore the potential of emerging market stock opportunities to diversify your portfolio and potentially enhance your long-term returns. Consult with a financial advisor before making any investment decisions.

Featured Posts

-

Hudsons Bay 65 Leases Attract Strong Interest

Apr 24, 2025

Hudsons Bay 65 Leases Attract Strong Interest

Apr 24, 2025 -

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025 -

Apr 24, 2025

Apr 24, 2025 -

California Gas Prices Governor Newsom Seeks Oil Industry Partnership To Ease Costs

Apr 24, 2025

California Gas Prices Governor Newsom Seeks Oil Industry Partnership To Ease Costs

Apr 24, 2025 -

Chinas Rare Earth Export Curbs Hamper Teslas Optimus Humanoid Robot Development

Apr 24, 2025

Chinas Rare Earth Export Curbs Hamper Teslas Optimus Humanoid Robot Development

Apr 24, 2025