ECB's Simkus: Two More Interest Rate Cuts Possible Amidst Trade War Impact

Table of Contents

Šimkus' Statements and their Significance

Gediminas Šimkus's pronouncements regarding potential interest rate cuts have sent ripples through financial markets. Understanding the significance of these statements requires careful analysis of their context and implications.

-

Direct quotes from Šimkus: While precise verbatim quotes require referencing official ECB transcripts, the essence of Šimkus's message revolved around the acknowledgment of subdued economic growth and the possibility of further monetary easing to counter this trend. He likely emphasized the persistent weakness in inflation and the need to prevent a further economic slowdown.

-

Contextual analysis: It's crucial to consider whether Šimkus's comments were conditional. Did he explicitly link further rate cuts to specific economic indicators reaching certain thresholds? His statements should be considered within the broader context of ECB communication strategy and the overall assessment of the Eurozone economy. Were these statements made in a formal press conference, an informal interview, or some other setting? This could influence interpretation.

-

Comparison to previous statements: A comparison of Šimkus's recent statements to previous ECB pronouncements on monetary policy is vital. Have there been shifts in the overall ECB stance? Has the perceived urgency for action increased? Assessing this evolution offers a clearer picture of the prevailing sentiment within the ECB.

-

Impact on market expectations: Šimkus's comments undoubtedly influenced market expectations regarding future interest rate decisions. These comments likely affected investor confidence, bond yields, and the Euro exchange rate. A weaker Euro could boost Eurozone exports, though it also depends on other economic factors.

The Impact of the Trade War on the Eurozone Economy

The ongoing trade war casts a long shadow over the Eurozone economy, significantly impacting growth and investment.

-

Mechanisms of negative impact: The trade war's effects are multifaceted. Reduced exports due to tariffs and trade barriers directly hurt Eurozone businesses reliant on global trade. Decreased investment reflects uncertainty among firms hesitant to commit to expansion in a volatile global environment. Supply chain disruptions, caused by trade tensions, further exacerbate these challenges.

-

Statistical data: To illustrate the slowdown, consider the latest Eurozone GDP growth figures, inflation rates, and unemployment statistics. These numbers paint a picture of subdued economic activity, highlighting the gravity of the situation. A decline in key economic indicators reinforces the need for intervention.

-

Sector-specific impacts: Certain Eurozone sectors are more vulnerable to trade disputes than others. Export-oriented industries, like automotive manufacturing and certain agricultural sectors, face immediate and significant repercussions. Understanding these sector-specific impacts helps tailor monetary policy responses effectively.

Current Economic Indicators and Inflation Expectations

Assessing the Eurozone's economic health necessitates a careful analysis of current indicators and inflation expectations.

-

Inflation data analysis: The ECB aims for inflation close to, but below, 2%. Analyzing current inflation data is crucial to determine whether it aligns with this target. A sustained deviation from this target might warrant further monetary easing.

-

Key economic indicator examination: Beyond inflation, analyzing GDP growth, unemployment rates, and consumer confidence offers a comprehensive picture. These indicators collectively paint a clearer image of the economic landscape.

-

Limitations of current indicators: It's vital to acknowledge the limitations of relying solely on current indicators to forecast future performance. Unexpected events, like escalating trade tensions, can significantly alter economic trajectories. Therefore, the ECB needs to consider a wider range of variables and scenarios.

Alternative Monetary Policy Options Beyond Interest Rate Cuts

While interest rate cuts are a key tool, the ECB has other options to stimulate the Eurozone economy.

-

Quantitative easing (QE): Restarting or expanding the ECB's QE program, which involves purchasing government bonds and other assets, could inject liquidity into the financial system, lowering borrowing costs and encouraging lending.

-

Alternative monetary policy tools: The ECB could also explore other non-standard monetary policy tools, such as targeted lending programs to specific sectors or negative interest rates on commercial banks' reserves. Each of these tools has its own set of potential benefits and drawbacks.

-

Political and economic constraints: The ECB's options are not without limits. Political resistance to further monetary easing, concerns about sovereign debt sustainability, and the risk of unintended consequences all influence the range of feasible policies.

Conclusion

Gediminas Šimkus's hint at further interest rate cuts underscores the ECB's concern over the Eurozone's economic slowdown, largely influenced by the escalating trade war. Current economic indicators, including subdued inflation and weaker-than-expected growth, signal a need for monetary easing. While interest rate cuts are a primary option, alternative measures like expanding QE are also under consideration. However, the ECB faces constraints including political considerations and economic risks associated with each tool.

The ECB's response to the trade war and economic slowdown remains crucial for the Eurozone’s economic stability. Stay informed about further developments in the ECB's monetary policy and the potential for further interest rate cuts. Follow our website for regular updates on the ECB's interest rate decisions and their implications for the Eurozone economy. Learn more about the impact of the trade war on the ECB’s interest rate strategy.

Featured Posts

-

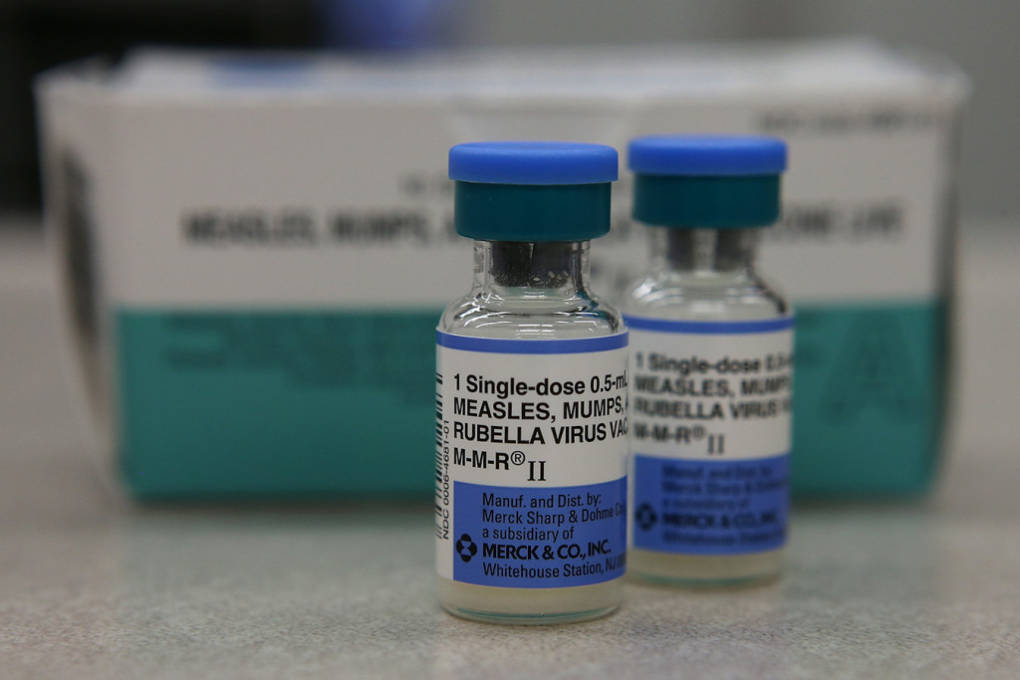

Nbc Los Angeles Hhs Taps Anti Vaccine Advocate To Examine Disproven Autism Vaccine Link

Apr 27, 2025

Nbc Los Angeles Hhs Taps Anti Vaccine Advocate To Examine Disproven Autism Vaccine Link

Apr 27, 2025 -

The Night Robert Pattinson Couldnt Sleep A Horror Movies Lasting Impact

Apr 27, 2025

The Night Robert Pattinson Couldnt Sleep A Horror Movies Lasting Impact

Apr 27, 2025 -

Ariana Grande Music Video Featuring Patrick Schwarzenegger A White Lotus Callback

Apr 27, 2025

Ariana Grande Music Video Featuring Patrick Schwarzenegger A White Lotus Callback

Apr 27, 2025 -

German Renewables Expansion Pne Group Receives Permits For Wind And Pv Projects

Apr 27, 2025

German Renewables Expansion Pne Group Receives Permits For Wind And Pv Projects

Apr 27, 2025 -

Dows Canadian Project Construction Delayed Amid Market Instability

Apr 27, 2025

Dows Canadian Project Construction Delayed Amid Market Instability

Apr 27, 2025