ECB's Initiative: A New Task Force For Simplified Banking Rules

Table of Contents

The European banking sector is grappling with a tangled web of regulations, a burden disproportionately impacting smaller banks. A recent study revealed that compliance costs consume an average of X% of smaller banks' annual revenue, hindering growth and innovation. To combat this, the European Central Bank (ECB) has launched a crucial initiative: a new task force dedicated to simplifying banking rules. This bold move aims to create a more efficient and competitive banking landscape across the Eurozone, fostering economic growth and stability.

The Rationale Behind the ECB's Initiative for Simplified Banking Rules

The current framework of EU banking regulations, while vital for financial stability, suffers from excessive complexity. This complexity translates into several key challenges:

- Excessive Bureaucracy and Administrative Burden: Navigating the intricate maze of regulations demands significant time and resources, especially for SMEs lacking dedicated compliance teams. This administrative burden often diverts attention from core business activities, hindering growth and innovation.

- High Compliance Costs: The sheer cost of adhering to these complex regulations is a major impediment, particularly for smaller banks with limited budgets. These costs often outweigh the benefits, forcing many to operate with reduced efficiency and competitiveness.

- Disproportionate Regulatory Requirements: Current rules sometimes impose similar burdens on both large and small banks, neglecting the varying resources and capabilities. This disproportionate approach hinders the growth and development of smaller financial institutions, stifling competition.

- Obstacles to Innovation and Lending: The complexity of regulations can discourage innovation by increasing the time and expense needed to develop and launch new financial products and services. This also restricts lending opportunities, impacting businesses and consumers alike.

The ECB's initiative directly addresses these issues by striving for simplification, thereby fostering a more dynamic and competitive banking sector within the Eurozone. The ultimate goal is to create a fairer playing field, enabling banks to better serve businesses and individuals while promoting economic growth.

Composition and Mandate of the New Task Force

The newly formed task force comprises a diverse group of experts, including representatives from major banks, national regulatory authorities, and independent legal experts with extensive experience in EU banking regulations. Their specific mandate includes:

- Identifying Areas for Simplification: The task force will meticulously analyze existing regulations, pinpointing areas where simplification can be achieved without compromising financial stability or consumer protection.

- Developing Proposals for Regulatory Changes: Based on its analysis, the task force will develop concrete proposals for regulatory reforms, aiming for clarity, efficiency, and proportionality.

- Consulting with Stakeholders: A key aspect of the task force's work involves extensive consultation with various stakeholders, including banks of all sizes, fintech companies, consumer groups, and other relevant parties. This ensures a comprehensive and balanced approach to regulatory reform.

- Submitting Recommendations to the ECB: The task force will formally submit its recommendations to the ECB, providing a detailed roadmap for implementing the proposed regulatory changes.

Potential Impacts of Simplified Banking Rules

Streamlining banking regulations promises numerous positive impacts throughout the Eurozone:

- Reduced Compliance Costs: Simplified rules will significantly reduce compliance costs for banks of all sizes, freeing up valuable resources for investment in new technologies, product development, and improved customer service.

- Improved Access to Credit: Reduced bureaucratic hurdles will translate into improved access to credit for businesses and consumers, supporting economic growth and job creation.

- Increased Efficiency and Innovation: A less cumbersome regulatory environment will stimulate innovation within the banking sector, fostering the development of new financial products and services tailored to the evolving needs of businesses and consumers.

- Stimulated Economic Growth: The combined effects of reduced costs, increased lending, and enhanced innovation will contribute to overall economic growth within the Eurozone.

- Enhanced Competitiveness of European Banks: Simplified regulations will level the playing field for European banks, enhancing their competitiveness on the global stage and attracting foreign investment.

Challenges and Potential Obstacles to Implementing Simplified Rules

Despite the significant potential benefits, implementing simplified banking rules presents certain challenges:

- Balancing Simplification with Risk Mitigation: The task force must carefully balance the need for simplification with the equally crucial need to maintain financial stability and consumer protection. This necessitates a delicate balancing act, ensuring that reforms do not inadvertently increase systemic risk.

- Ensuring Consistent Implementation Across EU Member States: Harmonizing the implementation of simplified rules across all EU member states will be critical to prevent regulatory arbitrage and ensure a level playing field for all banks.

- Addressing Potential Unintended Consequences: The task force must carefully anticipate and address potential unintended consequences of regulatory simplification, ensuring that reforms do not create new problems while solving existing ones.

- Managing Stakeholder Expectations and Concerns: Effective communication and engagement with all stakeholders will be essential to manage expectations and address concerns throughout the simplification process.

The Future of Banking Under the ECB's Initiative

The ECB's initiative to simplify banking regulations offers a transformative opportunity for the Eurozone's economy. By reducing the regulatory burden and fostering a more competitive banking sector, this initiative can unlock significant economic potential. The streamlined regulations promise a more efficient and dynamic financial landscape, benefiting banks, businesses, and consumers alike. Stay updated on the development of simplified banking rules under the ECB's initiative by following the ECB's publications and announcements. Learn more about the impact of the ECB's initiative on the banking sector and its implications for the future of finance in Europe.

Featured Posts

-

Bill Ackman On The Us China Trade War Time As A Deciding Factor

Apr 27, 2025

Bill Ackman On The Us China Trade War Time As A Deciding Factor

Apr 27, 2025 -

Controversial Mafs Groom Sam Carraros Five Minute Love Triangle Cameo

Apr 27, 2025

Controversial Mafs Groom Sam Carraros Five Minute Love Triangle Cameo

Apr 27, 2025 -

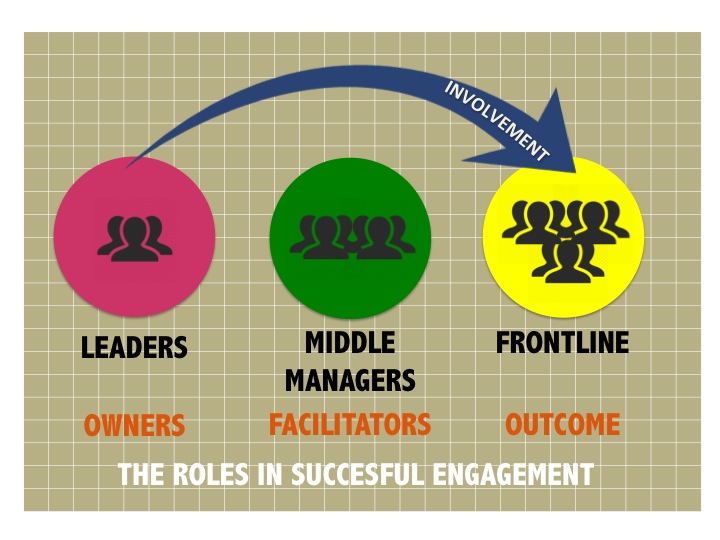

How Middle Management Drives Company Success And Employee Engagement

Apr 27, 2025

How Middle Management Drives Company Success And Employee Engagement

Apr 27, 2025 -

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025 -

Wta 1000 Dubai Eliminacion De Paolini Y Pegula

Apr 27, 2025

Wta 1000 Dubai Eliminacion De Paolini Y Pegula

Apr 27, 2025