ECB Launches Task Force For Simpler Banking Regulation

Table of Contents

The Rationale Behind the ECB's Initiative

The current regulatory framework for European banks is undeniably complex. The regulatory burden placed on financial institutions is substantial, leading to significant compliance costs. These costs aren't simply accounting entries; they represent resources diverted from core business activities, hindering innovation and potentially limiting growth. Overly complex regulations can also:

- Stifle Innovation: Banks may be less inclined to develop new products and services if the compliance hurdles are excessively high.

- Increase Costs for Banks: The cost of complying with complex regulations is passed on to consumers and businesses in the form of higher fees and interest rates.

- Limit Credit Availability: The increased burden on banks can reduce their lending capacity, potentially restricting credit availability for SMEs and consumers.

The ECB's primary goals in launching this simplification initiative are multifaceted:

- Improved efficiency in the banking sector: Streamlining regulations should free up resources and allow banks to operate more efficiently.

- Reduced compliance costs for banks: Lower compliance costs translate to lower operating costs for banks, potentially leading to lower fees and interest rates.

- Enhanced competitiveness of European banks: Simpler regulations could level the playing field, allowing European banks to compete more effectively on a global scale.

- Promotion of financial stability: While simplifying regulations, the ECB aims to maintain a robust and stable financial system.

- Benefits for SMEs and consumers: Easier access to credit, lower borrowing costs, and potentially lower fees for financial services are expected benefits.

The Composition and Mandate of the Task Force

The ECB's task force comprises a diverse group of experts, bringing together a wide range of perspectives and expertise. This "expert panel" includes representatives from:

- Leading European banks

- Key regulatory bodies

- Academic institutions specializing in financial regulation

- Representatives from relevant stakeholder groups

The task force's mandate is ambitious and far-reaching. It will focus on specific areas of banking regulation, including:

- Capital requirements: Evaluating the effectiveness and proportionality of current capital requirements.

- Liquidity rules: Streamlining liquidity regulations to ensure sufficient liquidity without excessive burdens.

- Reporting requirements: Reducing the complexity and burden of regulatory reporting.

- Supervisory processes: Improving the efficiency and effectiveness of supervisory processes.

The task force will employ a rigorous process, incorporating:

- Extensive public consultations to gather feedback from stakeholders.

- In-depth data analysis to identify areas for improvement.

- Collaboration with other relevant European regulatory bodies.

Potential Impacts of Simpler Banking Regulation

The potential benefits of simpler banking regulation are substantial. For banks, the anticipated effects include:

- Reduced compliance costs: Freeing up resources for investment in core business activities.

- Improved efficiency: Streamlined processes and reduced administrative burden.

- Increased profitability: Lower operating costs and enhanced competitiveness.

Businesses stand to gain from:

- Easier access to credit: Reduced barriers to obtaining financing for growth and expansion.

- Lower borrowing costs: Potentially lower interest rates due to reduced bank operating costs.

- Increased investment: Improved access to capital can stimulate business investment and economic growth.

Consumers can also expect benefits such as:

- Lower fees: Reduced bank operating costs could translate into lower fees for various financial services.

- Better access to financial services: Increased competition and efficiency could lead to better and more accessible financial services.

Concerns and Criticisms

While the initiative is largely welcomed, some concerns have been raised. There are worries about potential regulatory arbitrage – banks exploiting loopholes in simplified regulations – and the need to ensure sufficient oversight to maintain financial stability. Balancing simplification with robust regulatory control is a key challenge.

Conclusion: The Future of Banking Regulation in Europe – Simpler is Better

The ECB's initiative to simplify banking regulation represents a significant step towards a more efficient and competitive European banking sector. By reducing the regulatory burden on financial institutions, the task force aims to unlock innovation, reduce costs, and ultimately boost economic growth. The potential benefits for banks, businesses, and consumers are considerable, ranging from lower borrowing costs and fees to improved access to financial services. While challenges remain, the commitment to simpler banking regulation is a positive development for the future of the Eurozone's economy. To stay updated on the progress of the task force and the evolving landscape of simpler banking regulation in Europe, follow the ECB's website and subscribe to their newsletters. Learn more about the ECB's initiative and its impact on the future of finance.

Featured Posts

-

Eo W Complaint Pfc Alleges Falsified Documents From Gensol Engineering

Apr 27, 2025

Eo W Complaint Pfc Alleges Falsified Documents From Gensol Engineering

Apr 27, 2025 -

How To Buy Ariana Grandes Lovenote Fragrance Set Online Pricing And Availability

Apr 27, 2025

How To Buy Ariana Grandes Lovenote Fragrance Set Online Pricing And Availability

Apr 27, 2025 -

Local Jeweler Assists Nfl Players With Fresh Starts In Mc Cook

Apr 27, 2025

Local Jeweler Assists Nfl Players With Fresh Starts In Mc Cook

Apr 27, 2025 -

Ariana Grande Lovenote Fragrance Set Online Purchase Guide And Price Comparison

Apr 27, 2025

Ariana Grande Lovenote Fragrance Set Online Purchase Guide And Price Comparison

Apr 27, 2025 -

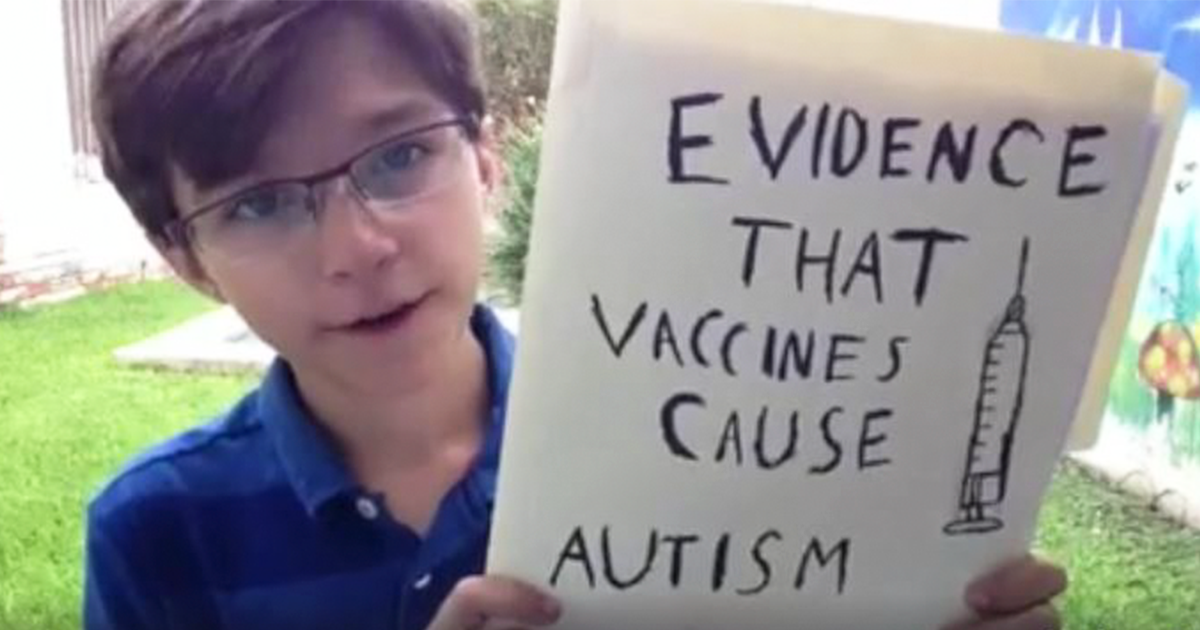

Hhs Investigation Into Debunked Autism Vaccine Connection Sparks Outrage

Apr 27, 2025

Hhs Investigation Into Debunked Autism Vaccine Connection Sparks Outrage

Apr 27, 2025