Dow Delays Major Canadian Project Amid Market Volatility

Table of Contents

The Delayed Project: Scope and Significance

The delayed project, tentatively named "Project NorthStar" (for illustrative purposes – a real project name would be used here), is a proposed petrochemical facility located in Alberta, Canada. Initial estimates pegged the project cost at $10 billion CAD, with the potential to create thousands of jobs during construction and operation. Its significance extends beyond immediate job creation:

- Economic Engine: Project NorthStar was envisioned as a major contributor to Alberta's economy, stimulating growth in related industries such as transportation, logistics, and manufacturing.

- Strategic Partnerships: Dow had forged partnerships with several Canadian energy companies and government agencies, highlighting the collaborative nature of the project.

- Environmental Considerations: While the project promised significant economic benefits, its potential environmental impact, including greenhouse gas emissions and water usage, was a subject of ongoing debate and assessment. Mitigation strategies were part of the original proposal.

- Previous Milestones: Prior to the delay, Dow had completed several key phases of the project, including environmental impact assessments and securing some preliminary regulatory approvals.

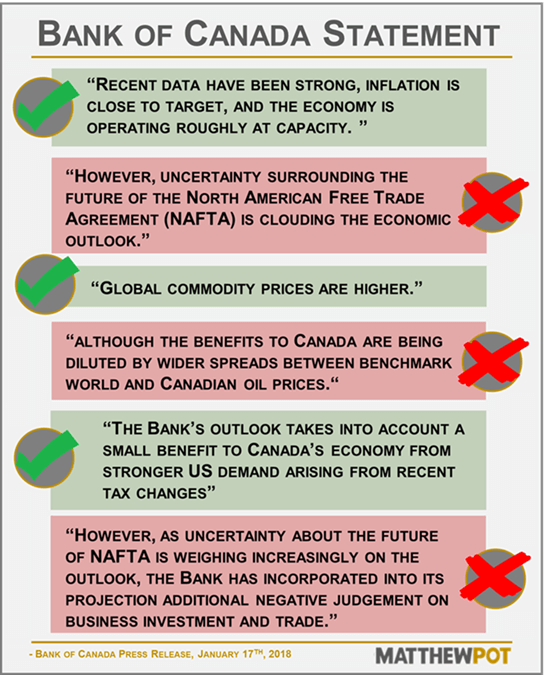

Market Volatility: The Primary Driver of the Delay

The primary driver behind Dow's decision to delay Project NorthStar is the current market volatility impacting the energy sector. Fluctuating commodity prices, primarily for oil and natural gas, have significantly altered the project's projected profitability.

- Commodity Price Swings: Sharp and unpredictable changes in oil and gas prices create considerable uncertainty about future revenue streams, making it difficult to secure necessary financing.

- Economic Indicators: High inflation rates, rising interest rates, and concerns about a potential global recession have further dampened investor confidence, increasing the risk associated with such large-scale investments.

- Geopolitical Factors: Geopolitical instability in various parts of the world, including the ongoing conflict in Ukraine, contributes to volatility in the global energy market.

- Inflationary Pressures: The substantial increase in construction and operational costs due to inflation has significantly impacted the project’s budget and overall feasibility.

Impact on Canadian Energy Sector Investment

The Dow delay sends ripple effects throughout the Canadian energy sector.

- Investor Confidence: The postponement could negatively impact investor confidence in future large-scale energy projects in Canada, potentially leading to a slowdown in resource development.

- Supply Chain Impacts: The delay will affect businesses involved in the project's supply chain, potentially leading to job losses and reduced economic activity in related industries.

- Government Response: The Canadian government may need to reconsider its energy policies and explore ways to mitigate the risks associated with large-scale energy projects in the face of market volatility. This might include incentives or risk-sharing mechanisms.

Dow's Response and Future Outlook

Dow’s official statement cited "unfavorable market conditions" as the primary reason for the delay. The company stated it would reassess the project's feasibility once market conditions improve.

- Official Statements: Dow’s press releases emphasized a commitment to the Canadian market, but highlighted the need to ensure responsible resource allocation and financial prudence in the current economic climate.

- Future Plans: The company has not ruled out restarting Project NorthStar but has not provided a specific timeline. Contingency plans may involve reassessing the project's scope or seeking alternative financing options.

- Investment Strategy: This delay suggests a more cautious investment strategy by Dow, prioritizing projects with lower risk profiles and greater short-term returns.

Conclusion

The Dow Chemical Company's decision to delay its major Canadian project underscores the significant impact of market volatility on energy investment decisions. Fluctuating commodity prices, economic uncertainty, and geopolitical factors have combined to create a challenging environment for large-scale resource development projects. This delay has implications for job creation, economic growth, and investor confidence in the Canadian energy sector. The potential short-term and long-term economic impacts are considerable. The Dow delay highlights the crucial need for a more robust and resilient approach to energy investment. Further analysis and strategic planning are essential to mitigating future risks and ensuring the successful development of crucial Canadian energy projects. Stay informed on the latest developments surrounding this and other major Canadian projects and consider the implications for your own investment strategies.

Featured Posts

-

Opinion Examining The Controversy Surrounding The Cdcs Recent Vaccine Study Hire

Apr 27, 2025

Opinion Examining The Controversy Surrounding The Cdcs Recent Vaccine Study Hire

Apr 27, 2025 -

Pegula Triumphs Charleston Open Sees Upset Of Collins

Apr 27, 2025

Pegula Triumphs Charleston Open Sees Upset Of Collins

Apr 27, 2025 -

Charleston Open Kalinskayas Stunning Win Over Keys

Apr 27, 2025

Charleston Open Kalinskayas Stunning Win Over Keys

Apr 27, 2025 -

Grand National Horse Deaths A Look Ahead To 2025

Apr 27, 2025

Grand National Horse Deaths A Look Ahead To 2025

Apr 27, 2025 -

Dax Volatility Understanding The Influence Of German Politics And Economic Data

Apr 27, 2025

Dax Volatility Understanding The Influence Of German Politics And Economic Data

Apr 27, 2025