Credit Card Issuers Respond To Shifting Consumer Spending Habits

Table of Contents

The Rise of Digital and Contactless Payments

The increasing preference for digital and contactless payment methods is reshaping the credit card landscape. Consumers are increasingly embracing mobile wallets like Apple Pay and Google Pay, utilizing Near Field Communication (NFC) technology for seamless transactions at physical retail locations and online. This shift towards digital payments is driven by convenience, speed, and enhanced security features. The growth of e-commerce and mobile banking further fuels this trend.

- Increased adoption of mobile payment apps: The convenience and speed offered by mobile payment apps are driving significant growth in their usage. This allows consumers to make purchases quickly and securely without needing to physically carry their credit cards.

- Growth of contactless transactions at physical retail locations: Contactless payments using NFC technology are becoming the norm at many retail outlets, providing a quick and hygienic alternative to traditional chip and PIN transactions.

- The role of security and fraud prevention in digital payment adoption: Robust security measures, including tokenization and biometric authentication, are crucial for building consumer confidence in digital payment systems and mitigating fraud risks.

- Integration of digital payment options with credit card rewards programs: Credit card issuers are integrating digital payment options seamlessly with their rewards programs, ensuring that consumers can earn points or cashback regardless of their payment method.

The Impact of Buy Now, Pay Later (BNPL) Services

Buy Now, Pay Later (BNPL) services represent a significant disruption to the traditional credit card market. These services, offering installment payment options at the point of sale, have gained immense popularity, particularly among younger consumers. This popularity is fueled by the ease of access and immediate gratification they provide, bypassing the credit application process associated with traditional credit cards.

- The increasing popularity of BNPL among younger consumers: Younger generations are particularly drawn to BNPL's user-friendly interface and flexible payment options.

- The advantages and disadvantages of BNPL compared to credit cards: While BNPL offers convenience, it often comes with higher interest rates and potential risks if payments are missed. Credit cards, conversely, offer greater rewards and credit-building opportunities but may involve a more rigorous application process.

- Strategies credit card issuers are employing to compete with BNPL: Credit card issuers are responding to the BNPL challenge by integrating similar installment payment options into their offerings, allowing consumers to split purchases into manageable payments.

- The regulatory landscape surrounding BNPL and its implications: The regulatory environment surrounding BNPL is evolving, with governments worldwide scrutinizing these services to ensure consumer protection and address potential risks.

Evolving Credit Card Rewards and Benefits

Credit card issuers are constantly innovating their rewards programs to remain competitive and attract customers. The focus is shifting from traditional points-based systems to personalized rewards tailored to individual spending habits. This involves leveraging data analytics to understand customer preferences and offer targeted benefits.

- The shift from traditional points-based systems to personalized rewards: Generic rewards programs are being replaced by systems that reward customers based on their specific spending patterns.

- The increased focus on experiences and travel rewards: Experiential rewards, such as travel upgrades or concert tickets, are increasingly popular, reflecting the changing consumer desire for unique and memorable experiences.

- Competition in offering unique and valuable rewards to attract customers: Credit card issuers are vying to offer the most compelling rewards packages, creating intense competition and innovation in the rewards space.

- The use of data analytics to tailor rewards to individual spending habits: Data analytics play a crucial role in personalizing rewards programs, making them more relevant and appealing to customers.

Emphasis on Financial Wellness and Customer Service

Credit card issuers are increasingly recognizing the importance of promoting financial wellness among their customers. This involves offering tools and resources to help consumers manage their finances responsibly, understand their credit scores, and avoid debt traps. Improved customer service is also a key element.

- Integration of budgeting and financial management tools into credit card apps: Many credit card companies are incorporating budgeting tools and financial management features directly into their mobile apps, providing customers with convenient access to resources.

- Provision of educational resources on responsible credit card use: Educating customers about responsible spending habits and credit management is vital for fostering financial literacy and preventing financial difficulties.

- Improved customer service channels and responsiveness: Providing readily available and responsive customer service channels is crucial for building customer loyalty and trust.

- Focus on personalized financial advice and support: Offering personalized financial advice and support tailored to individual needs can significantly enhance the customer experience and promote responsible credit card use.

Conclusion

Credit card issuers face a dynamic landscape driven by the changing spending habits of consumers. To remain competitive, issuers are adapting by embracing digital technologies, innovating rewards programs, and prioritizing customer financial wellness. The rise of digital payments, the impact of BNPL services, and the evolution of rewards programs are all reshaping the industry. Understanding these shifts is crucial for both consumers and the credit card issuers themselves. Stay informed about the latest trends in credit card offerings and choose wisely to maximize your financial benefits. Learn more about how credit card issuers are responding to shifting consumer spending habits by exploring our further resources [link to relevant resources].

Featured Posts

-

Ai Boosts Sk Hynix To Top Dram Manufacturer Surpassing Samsung

Apr 24, 2025

Ai Boosts Sk Hynix To Top Dram Manufacturer Surpassing Samsung

Apr 24, 2025 -

Bold And The Beautiful Spoilers February 20 Liam Steffy And Finns Storylines

Apr 24, 2025

Bold And The Beautiful Spoilers February 20 Liam Steffy And Finns Storylines

Apr 24, 2025 -

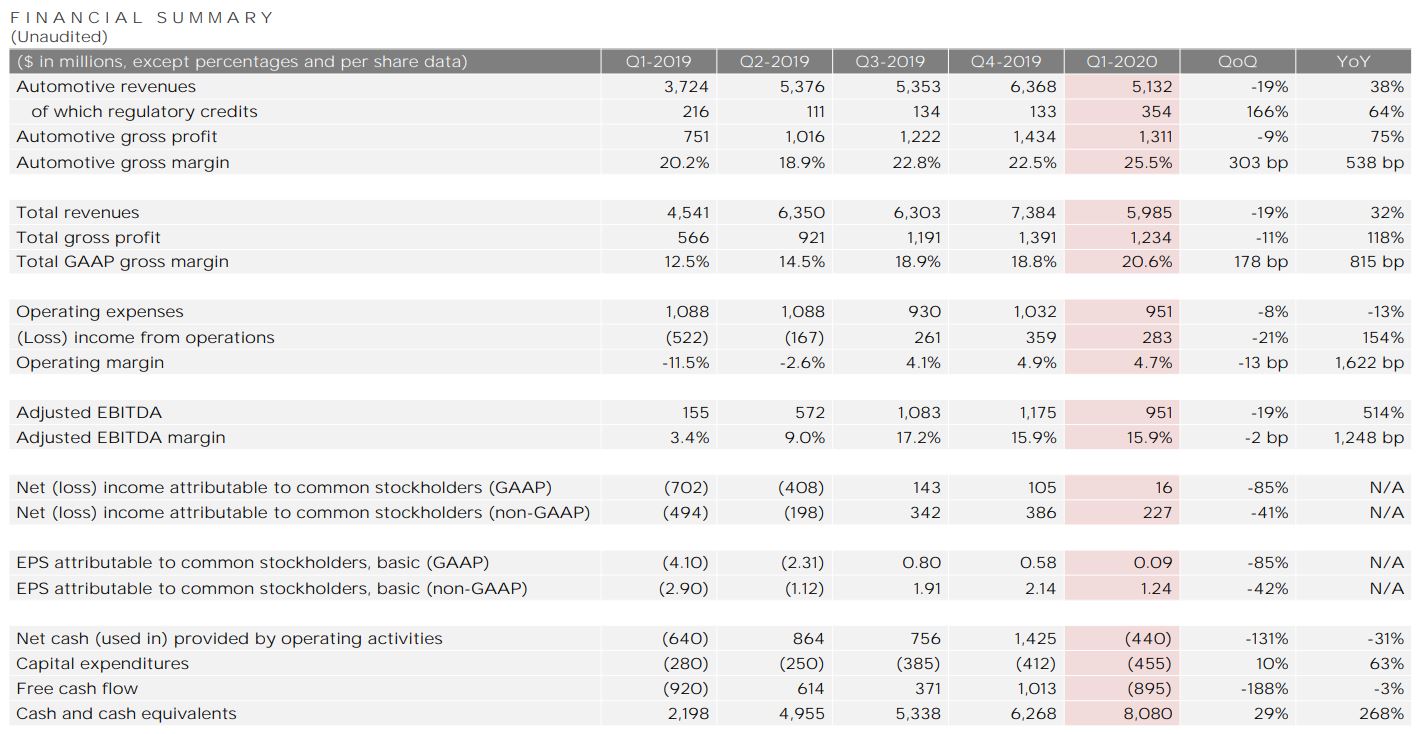

Tesla Q1 Financial Results Political Controversy Impacts Profitability

Apr 24, 2025

Tesla Q1 Financial Results Political Controversy Impacts Profitability

Apr 24, 2025 -

The Significance Of Destroying The Popes Ring A Look At Catholic Tradition

Apr 24, 2025

The Significance Of Destroying The Popes Ring A Look At Catholic Tradition

Apr 24, 2025 -

The Bold And The Beautiful April 3rd Liam And Bills Explosive Argument Ends In Collapse

Apr 24, 2025

The Bold And The Beautiful April 3rd Liam And Bills Explosive Argument Ends In Collapse

Apr 24, 2025