Canadian Dollar Weakness: Diving Despite US Dollar Gains

Table of Contents

Weakening Canadian Economy

The Canadian economy's performance significantly impacts the loonie's strength. Several factors contribute to this weakening:

Impact of Falling Commodity Prices

Canada's economy heavily relies on exports of natural resources, including oil and other commodities. Lower global prices for these resources directly impact export revenue, impacting the Canadian dollar exchange rate. Reduced revenue also affects government finances and investor confidence, leading to further downward pressure on the loonie.

- Decreased demand for Canadian resources: Global economic slowdown and reduced industrial activity have decreased demand for Canadian commodities.

- Global economic slowdown: A weakening global economy reduces demand for Canadian exports across the board.

- Competition from other producers: Increased competition from other resource-producing nations puts downward pressure on Canadian commodity prices.

Slowing Economic Growth

Concerns about a potential recession in Canada are adding to the loonie's woes. High inflation and the Bank of Canada's interest rate hikes are slowing consumer spending and business investment, further dampening economic growth.

- GDP growth forecasts: Recent forecasts indicate slower-than-expected GDP growth for Canada, fueling concerns about economic stagnation.

- Consumer confidence index: A declining consumer confidence index reflects reduced spending and overall economic uncertainty.

- Business investment trends: Businesses are delaying or reducing investment due to economic uncertainty and high interest rates.

US Dollar Strength

The persistent strength of the US dollar is another major factor contributing to Canadian dollar weakness.

Safe-Haven Status of the US Dollar

The US dollar remains a global safe-haven asset. During times of economic uncertainty or geopolitical instability, investors flock to the US dollar, increasing its demand and bolstering its value against other currencies, including the loonie.

- Global geopolitical risks: The ongoing war in Ukraine and other geopolitical tensions increase investor uncertainty, driving capital flows into the US dollar.

- Inflation concerns in other countries: High inflation rates globally make the US dollar a more attractive option compared to currencies experiencing greater inflation.

- Flight to safety capital flows: Investors move their assets to safer havens like the US dollar during times of market volatility.

Diverging Monetary Policies

The Federal Reserve's (the US central bank) aggressive interest rate hikes to combat inflation are significantly strengthening the US dollar. The Bank of Canada's monetary policy, while also focused on inflation control, is less aggressive, creating a relative interest rate differential that favors the US dollar. This interest rate differential impacts currency exchange rates, making the US dollar more attractive to investors seeking higher returns.

- Comparison of interest rate hikes between the US and Canada: The significant difference in the pace of interest rate hikes between the two countries directly impacts the exchange rate.

- Impact on currency exchange rates: Higher interest rates in the US attract foreign investment, increasing demand for the US dollar and putting downward pressure on the Canadian dollar.

Other Contributing Factors

Beyond economic factors, other elements contribute to Canadian dollar weakness.

Geopolitical Uncertainty

Global events significantly influence investor sentiment and currency markets. Geopolitical uncertainty often leads to increased demand for safe-haven assets like the US dollar, further pressuring the Canadian dollar.

- Specific geopolitical events and their impact: Events such as the war in Ukraine create uncertainty and influence investor decisions regarding currency holdings.

- Investor risk aversion: During times of geopolitical instability, investors tend to reduce risk by moving towards more stable currencies like the US dollar.

Trade Balance

A widening trade deficit can negatively impact a country's currency. If Canada imports more than it exports, the demand for foreign currencies increases, weakening the Canadian dollar.

- Analysis of Canada's trade balance: Monitoring the trade balance reveals the extent to which imports exceed exports, providing insight into pressure on the Canadian dollar.

- Import/export data: Examining import and export data helps understand the dynamics of Canada's trade relationships and their influence on the loonie.

Conclusion

The Canadian dollar's weakness is a multifaceted issue resulting from a combination of factors: a slowing Canadian economy, the strengthening US dollar, and global geopolitical uncertainties. Understanding these factors is vital for investors and businesses operating in the current economic landscape. To stay informed about fluctuations and potential future trends, monitor economic indicators, news concerning Bank of Canada policy decisions, and global events that impact currency exchange rates. Staying updated on Canadian dollar weakness is crucial for making informed financial decisions.

Featured Posts

-

Israeli Beach Sees Tragedy After Years Of Shark Drawn Crowds

Apr 24, 2025

Israeli Beach Sees Tragedy After Years Of Shark Drawn Crowds

Apr 24, 2025 -

Canadian Auto Dealers Propose Five Point Plan Amidst Us Trade War

Apr 24, 2025

Canadian Auto Dealers Propose Five Point Plan Amidst Us Trade War

Apr 24, 2025 -

Saudi Arabia And India To Build Two Joint Oil Refineries

Apr 24, 2025

Saudi Arabia And India To Build Two Joint Oil Refineries

Apr 24, 2025 -

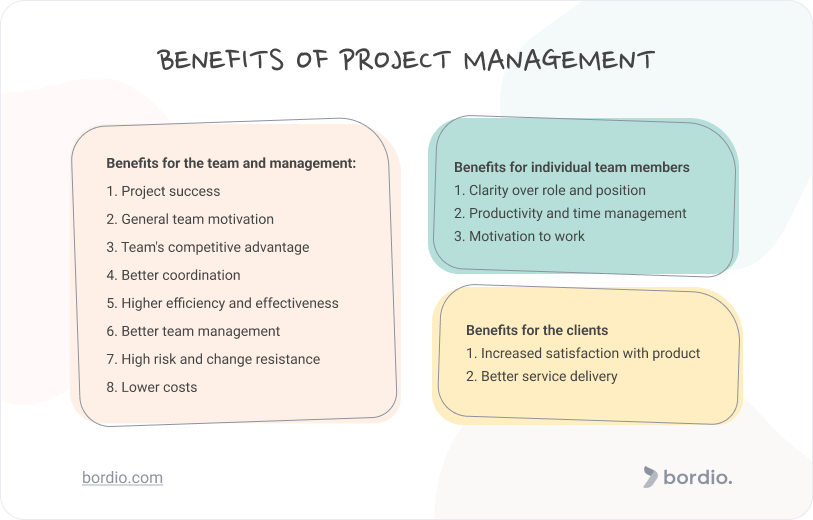

The Crucial Role Of Middle Management Benefits For Companies And Employees

Apr 24, 2025

The Crucial Role Of Middle Management Benefits For Companies And Employees

Apr 24, 2025 -

Blue Origin Cancels Launch Details On The Vehicle Subsystem Problem

Apr 24, 2025

Blue Origin Cancels Launch Details On The Vehicle Subsystem Problem

Apr 24, 2025