BTC Rally: How Trump's Policies And Fed Decisions Impact Bitcoin's Value

Table of Contents

Trump's Economic Policies and their Ripple Effect on BTC

The economic landscape shaped by the Trump administration had a profound, albeit indirect, effect on Bitcoin's price. Analyzing these effects reveals how macroeconomic forces can influence even decentralized digital assets.

Fiscal Stimulus and Inflation

Trump's economic policies, characterized by significant tax cuts and increased government spending, fueled a period of substantial economic growth. However, this fiscal stimulus also led to increased inflation. When the money supply expands rapidly, the purchasing power of each unit of currency diminishes, leading to price increases across the board. This inflationary environment can make Bitcoin an attractive alternative asset for investors seeking to hedge against the erosion of their purchasing power. Investors often view Bitcoin as a store of value, similar to gold, but with the added benefit of being digital and decentralized.

- Increased money supply: Trump's fiscal policies injected vast sums of money into the economy, increasing the overall money supply.

- Weakening US dollar: The increased money supply contributed to a decline in the value of the US dollar, making alternative assets like Bitcoin relatively more attractive.

- Investor search for inflation hedges: Investors actively sought assets that could preserve their wealth amidst rising inflation, leading to increased demand for Bitcoin.

Trade Wars and Geopolitical Uncertainty

Trump's trade policies, marked by significant tariffs and trade disputes with various countries, introduced considerable uncertainty into global markets. This uncertainty often drives investors towards assets perceived as safe havens, or those less susceptible to the whims of geopolitical tensions. Bitcoin, with its decentralized nature and relative independence from traditional financial institutions, fits this description. The lack of centralized control makes it less vulnerable to the impact of specific national policies or international conflicts.

- Increased market volatility: Trade wars created a volatile market environment, encouraging investors to diversify their portfolios with assets like Bitcoin.

- Safe-haven asset demand: Amidst uncertainty, investors flocked towards assets perceived as safe havens, boosting Bitcoin's demand.

- Flight to digital gold: Bitcoin's decentralized nature and scarcity, often compared to gold, contributed to its appeal as a digital safe haven during times of geopolitical stress.

The Federal Reserve's Role in BTC Price Fluctuations

The Federal Reserve's monetary policy decisions also significantly impact Bitcoin's price, often in an inverse relationship. Understanding the Fed's actions is crucial to anticipating potential movements in the Bitcoin market.

Interest Rate Hikes and Bitcoin's Inverse Correlation

The Fed's interest rate hikes typically influence the price of Bitcoin inversely. Higher interest rates make traditional investments like bonds and savings accounts more attractive, often leading to a shift in capital away from riskier assets, including Bitcoin. This is because higher returns on traditional investments reduce the incentive to invest in assets perceived as more volatile. Additionally, interest rate hikes often strengthen the US dollar, making Bitcoin, priced in USD, relatively more expensive.

- Impact on bond yields: Higher interest rates increase bond yields, making bonds a more competitive investment compared to Bitcoin.

- Dollar strength versus Bitcoin: A stronger US dollar reduces Bitcoin's price in dollar terms.

- Risk-off sentiment in markets: Higher interest rates often signal a more conservative market sentiment, leading investors to move towards less risky assets.

Quantitative Easing and Bitcoin's Growth

Conversely, periods of quantitative easing (QE), where the Fed injects liquidity into the market by purchasing assets, can indirectly boost Bitcoin's price. This injection of liquidity often increases the money supply, potentially leading to inflation and a search for higher returns. Bitcoin, as a relatively new and potentially high-growth asset, can become attractive to investors seeking higher returns compared to low-yield traditional investments.

- Increased money supply: QE programs increase the money supply, creating a potentially inflationary environment.

- Search for higher returns: Investors seek assets that offer potentially higher returns than low-yield traditional investments.

- Speculative investment in BTC: The increased liquidity and search for higher returns can drive speculative investment in Bitcoin.

Conclusion

This article explored the complex interplay between former President Trump's economic policies, Federal Reserve decisions, and their consequential impact on Bitcoin's price. Both fiscal stimulus and trade wars under Trump's administration, combined with the Fed's monetary policy adjustments, significantly shaped investor sentiment and capital flows towards Bitcoin, resulting in periods of both substantial growth and sharp declines. Understanding these macroeconomic factors is essential for developing a well-informed investment strategy in the unpredictable cryptocurrency market.

Call to Action: Stay informed on macroeconomic trends and Federal Reserve decisions to better predict and navigate future BTC rallies. Continue your research into the multifaceted influence of government policies on Bitcoin value and formulate your own informed strategy for successful navigation of the BTC market.

Featured Posts

-

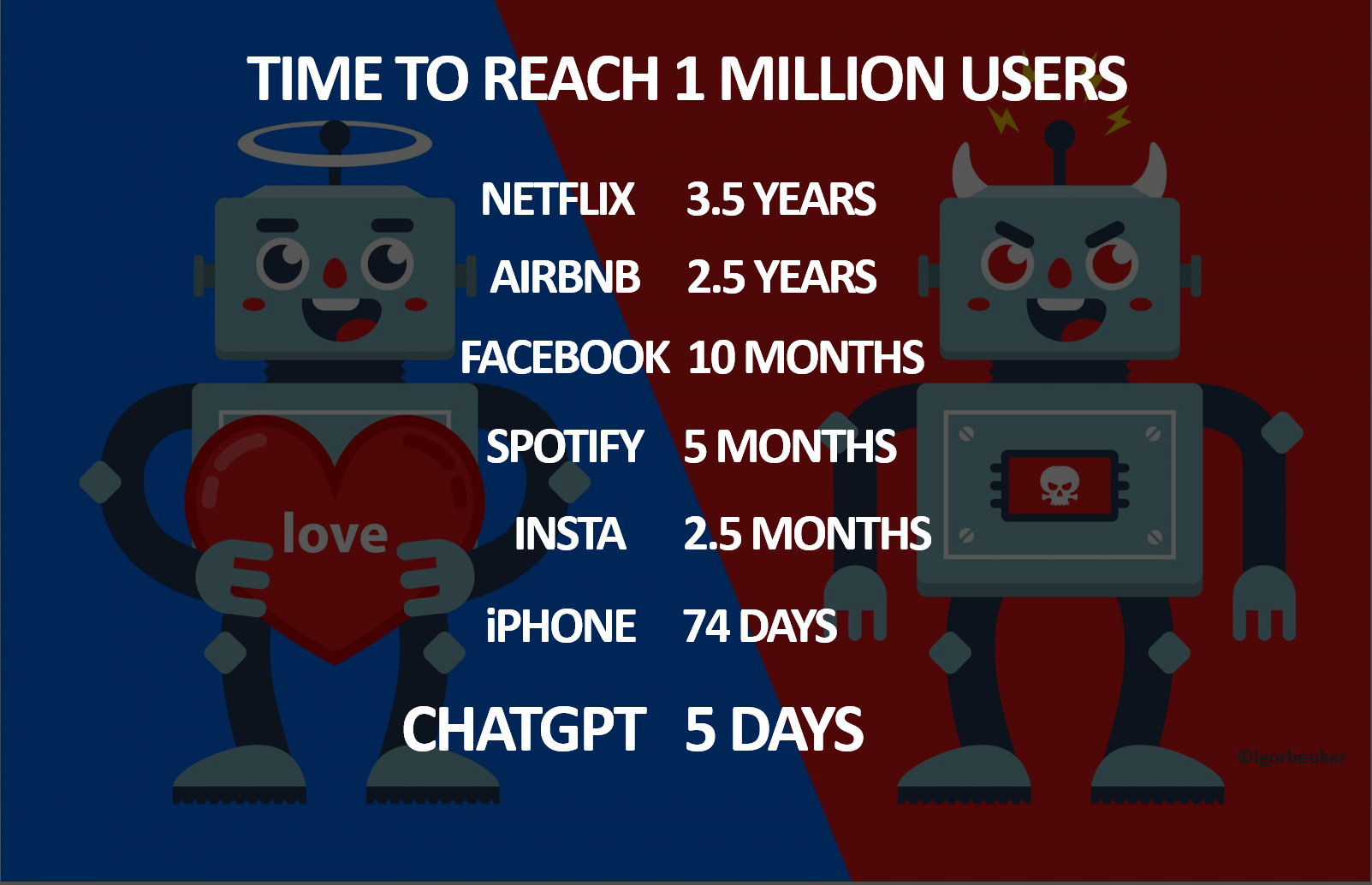

Open Ais Interest In Google Chrome Fact Or Fiction A Chat Gpt Chiefs Perspective

Apr 24, 2025

Open Ais Interest In Google Chrome Fact Or Fiction A Chat Gpt Chiefs Perspective

Apr 24, 2025 -

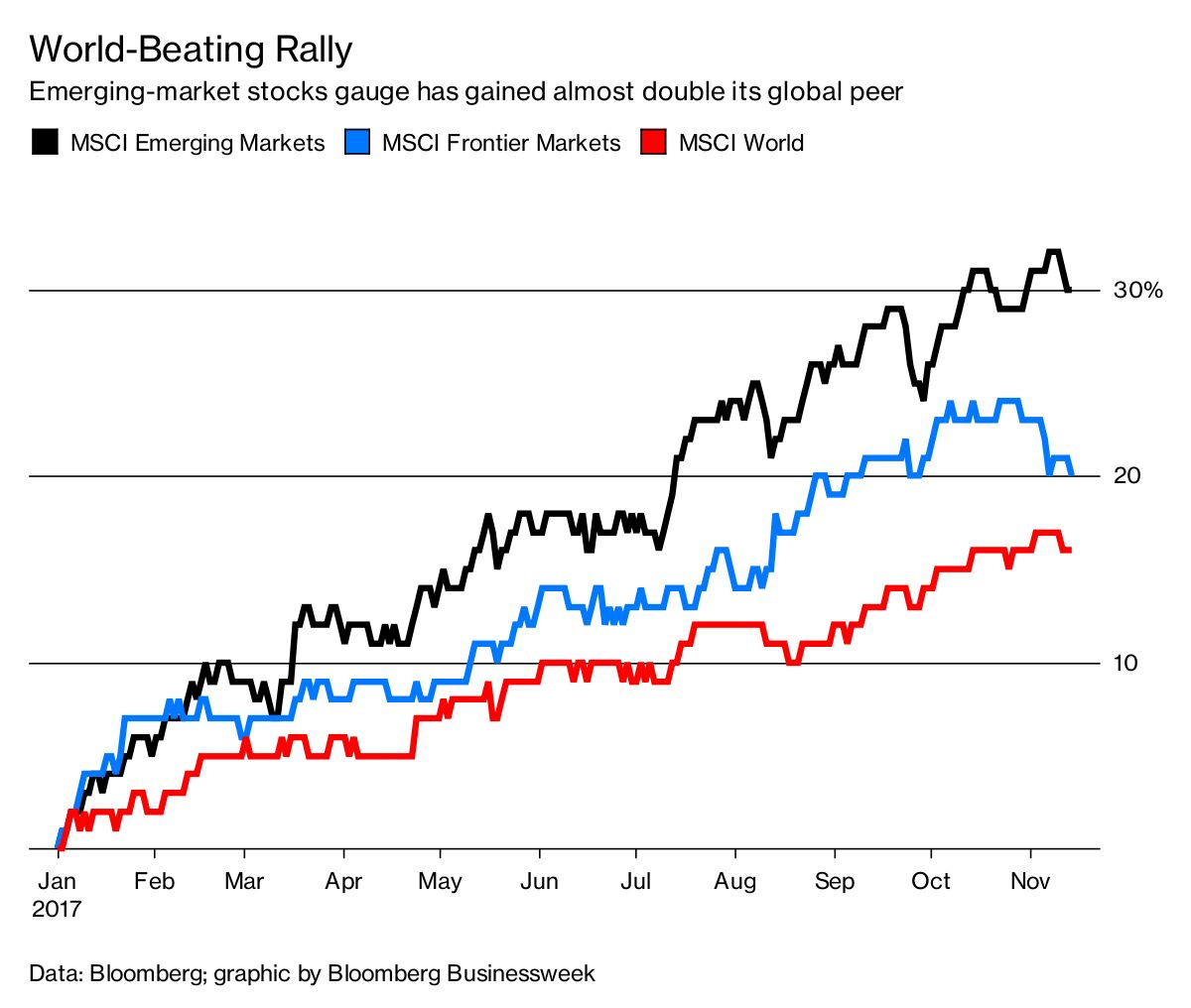

Emerging Market Stocks Outperform Us Year To Date Gains

Apr 24, 2025

Emerging Market Stocks Outperform Us Year To Date Gains

Apr 24, 2025 -

Bitcoin Btc Price Surge Trumps Actions And Fed Influence

Apr 24, 2025

Bitcoin Btc Price Surge Trumps Actions And Fed Influence

Apr 24, 2025 -

Elon Musk Doge And The Epa A Tesla And Space X Investigation

Apr 24, 2025

Elon Musk Doge And The Epa A Tesla And Space X Investigation

Apr 24, 2025 -

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025