BofA's Take On Elevated Stock Market Valuations: Should Investors Worry?

Table of Contents

BofA's Current Market Outlook

BofA's assessment of the current stock market environment is multifaceted, considering numerous economic indicators. They meticulously track key metrics like Price-to-Earnings (P/E) ratios, interest rates, inflation levels, and economic growth forecasts to formulate their outlook.

-

BofA's Predicted Market Direction: While specific predictions change frequently, BofA's recent reports often reflect a cautiously optimistic, or neutral stance. They acknowledge the risks associated with high valuations but also point to potential opportunities within specific sectors. This balanced approach avoids overly bullish or bearish pronouncements.

-

Key Economic Factors Influencing their Outlook: Inflation remains a significant concern, impacting interest rate decisions and corporate profitability. Recession risks, while debated, are factored into BofA's analysis. Geopolitical events and supply chain disruptions also play a crucial role in shaping their overall outlook.

-

Specific Sectors BofA Views Favorably or Unfavorably: BofA's sector-specific analyses often highlight opportunities in resilient sectors like technology and healthcare, while expressing some caution regarding sectors heavily reliant on consumer spending, depending on the economic climate.

-

Reference to BofA Reports: For the most up-to-date information, refer to BofA's official publications and research reports available on their website. [Insert link to BofA's research reports if available]. These reports often provide detailed analysis and data supporting their market outlook and stock market predictions.

BofA's Analysis of Elevated Valuations

BofA's analysis of elevated stock market valuations is rigorous and multi-faceted. They utilize a variety of valuation metrics to assess whether current prices are justified.

-

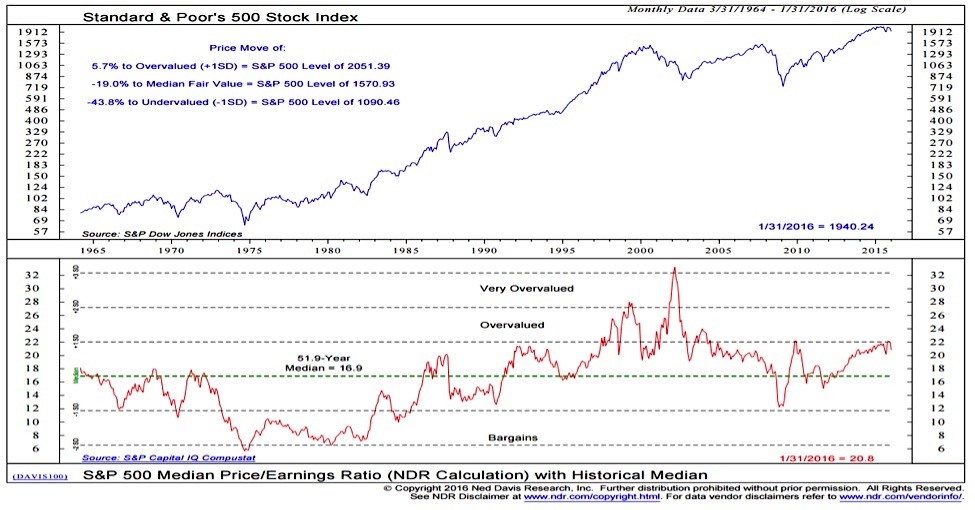

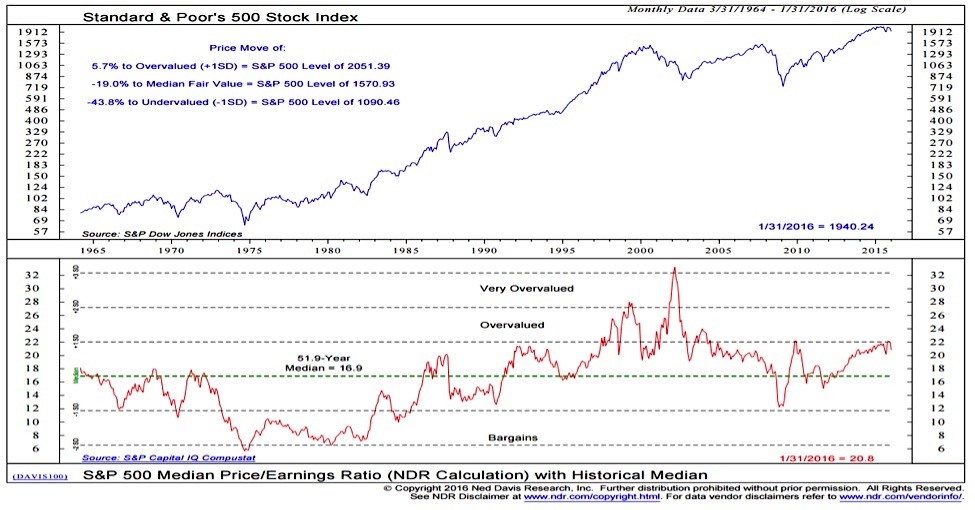

Specific Valuation Metrics: BofA employs several key valuation metrics, including the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and other fundamental measures to gauge whether a stock is overvalued or undervalued.

-

Comparison to Historical Averages: A crucial aspect of BofA's analysis involves comparing current valuations to historical averages. They examine long-term trends to assess whether the current level represents a significant deviation from historical norms.

-

Justification for High or Low Valuations: BofA's justification for high or low valuations depends on various factors. Strong earnings growth, low interest rates (historically), and rapid technological advancements can support higher valuations. Conversely, concerns about slowing economic growth or rising interest rates could justify lower valuations.

-

Potential Risks: BofA acknowledges the inherent risks associated with high valuations. A significant market correction, where prices fall sharply, is a possibility if these valuations are not supported by future earnings growth. Decreased profitability across sectors could also lead to downward pressure on stock prices, creating investment risk.

BofA's Recommendations for Investors

Given the current environment of elevated stock market valuations, BofA typically advises a cautious yet opportunistic approach to investing.

-

Investment Strategies: BofA often recommends a diversified portfolio strategy to mitigate risk. This could involve allocating investments across various asset classes (stocks, bonds, real estate, etc.) and sectors. Value investing and growth investing strategies might be employed based on specific market conditions.

-

Sectors and Asset Classes: Based on their outlook, BofA might suggest specific sectors or asset classes for consideration. These might include sectors perceived as less vulnerable to economic downturns or those poised for significant growth.

-

Risk Management and Portfolio Adjustments: BofA emphasizes the importance of risk management. Investors are encouraged to regularly review their portfolios and make adjustments based on their risk tolerance and changing market conditions.

-

Hedging Strategies: In a high-valuation environment, BofA may suggest hedging strategies to protect against potential market downturns. These could involve using derivatives or other financial instruments to reduce risk.

Alternative Perspectives on Elevated Stock Market Valuations

While BofA's analysis is insightful, it's important to consider alternative perspectives. Other financial institutions and experts may hold differing views on the implications of elevated stock market valuations.

-

Contrasting Viewpoints: Some analysts might argue that current valuations are justified by strong economic fundamentals and technological innovation. Others might express stronger concerns about the potential for a market correction.

-

Sources of Alternative Viewpoints: Major investment banks, financial news outlets (such as the Financial Times, Bloomberg, or the Wall Street Journal), and independent financial analysts offer a range of opinions on market valuations.

-

Key Differences: These differences often stem from variations in the assumptions used in their analysis, such as differing forecasts for economic growth, inflation, or interest rates.

Conclusion

BofA's analysis of elevated stock market valuations reveals a complex picture. While acknowledging the risks associated with high valuations, they often maintain a cautiously optimistic outlook, identifying potential opportunities within specific sectors and urging diversification. Their recommendations emphasize prudent risk management and a balanced investment approach. Remember to conduct thorough research, considering multiple viewpoints like those presented here, and to consult a financial advisor for personalized investment advice tailored to your individual financial situation and risk tolerance before making any investment decisions based on current stock market valuations.

Featured Posts

-

Zuckerberg And The Trump Era A New Phase For Meta

Apr 26, 2025

Zuckerberg And The Trump Era A New Phase For Meta

Apr 26, 2025 -

White House Cocaine Incident Secret Services Final Report

Apr 26, 2025

White House Cocaine Incident Secret Services Final Report

Apr 26, 2025 -

Should You Return To A Company That Laid You Off A Guide To Your Decision

Apr 26, 2025

Should You Return To A Company That Laid You Off A Guide To Your Decision

Apr 26, 2025 -

American Battleground A David Vs Goliath Showdown With The Worlds Richest Man

Apr 26, 2025

American Battleground A David Vs Goliath Showdown With The Worlds Richest Man

Apr 26, 2025 -

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

Apr 26, 2025

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

Apr 26, 2025

Latest Posts

-

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025 -

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025 -

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025 -

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025 -

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025