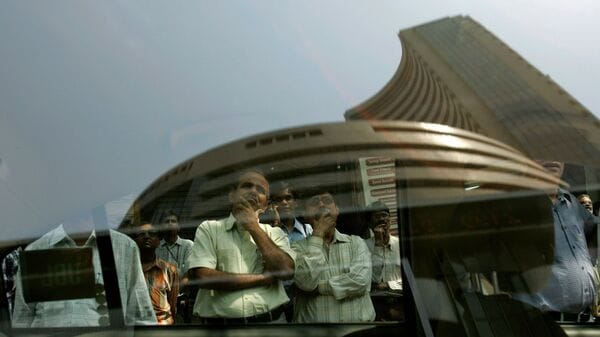

BofA Says: Don't Worry About Stretched Stock Market Valuations

Table of Contents

BofA's Rationale Behind Downplaying Valuation Concerns

BofA's relatively optimistic outlook on stretched stock market valuations rests on several key pillars. They suggest that a nuanced understanding of current economic conditions is crucial before jumping to conclusions.

Low Interest Rates as a Supporting Factor

Low interest rates significantly impact stock valuations. Historically low interest rates justify higher price-to-earnings (P/E) ratios and other valuation metrics. This is because:

- Discounted Cash Flow (DCF) Model: Lower discount rates used in the DCF model, a common valuation technique, lead to higher present values of future cash flows, thus supporting higher stock prices. A lower discount rate essentially means future earnings are worth more today.

- Investor Expectations: When interest rates are low, investors are less inclined to seek high-yield, low-risk investments like bonds. This increased appetite for risk can drive up demand for equities, further inflating valuations. This is particularly true when comparing the returns offered by government bonds to the returns expected from investing in the stock market.

- Impact on Valuation Metrics: Low rates can lead to higher P/E ratios, which are often used as a benchmark for assessing whether stocks are overvalued or undervalued. A higher P/E ratio does not automatically signal overvaluation if interest rates are exceptionally low.

Strong Corporate Earnings and Growth Prospects

BofA points to strong corporate earnings and robust growth prospects as another key justification for their assessment. Their analysis highlights:

- Positive Earnings Growth: Many sectors are experiencing healthy earnings growth, exceeding initial predictions. BofA's research frequently highlights companies and sectors they believe are poised for continued success.

- Bullish Outlook for Key Sectors: BofA has expressed a bullish outlook on several key sectors, including technology, healthcare, and certain consumer staples, based on their projection of strong earnings growth in these areas. Specific data points from their research reports would be needed to give concrete examples.

- Stock Market Performance: The consistent, if somewhat uneven, growth in the stock market, while incorporating market corrections, underpins their positive view.

The Role of Inflation and Monetary Policy

Inflation and the Federal Reserve's monetary policy response play a critical role in BofA's analysis of stretched stock market valuations.

- Inflation Predictions: BofA incorporates forecasts on inflation into their valuation models, considering how rising prices could impact corporate profitability and investor sentiment. Their predictions on inflation rates are crucial to their assessment.

- Interest Rate Hikes: The Federal Reserve's decisions regarding interest rate hikes significantly influence stock valuations. BofA's assessment includes projections on future rate increases and their expected effect on stock prices and market volatility.

- Potential Counterarguments: It's important to acknowledge that some analysts disagree with BofA's assessment, arguing that persistent inflation could lead to more aggressive rate hikes, potentially triggering a significant market correction. This viewpoint warrants careful consideration.

Counterarguments and Potential Risks

While BofA presents a relatively optimistic view, it's crucial to consider counterarguments and potential risks associated with high valuations.

The Perils of Overvaluation

High stock valuations inherently carry risks:

- Market Correction: Overvalued markets are susceptible to sharp corrections, where prices decline significantly and rapidly. This risk is amplified by the current high valuations.

- Rising Interest Rates: As interest rates rise, the attractiveness of bonds increases, potentially leading investors to shift away from stocks, thereby putting downward pressure on prices. This is a classic factor influencing market valuations.

- Risk Assessment: A thorough risk assessment is essential for investors, considering the potential for significant losses in a market correction driven by overvaluation.

Alternative Perspectives on Stock Market Valuations

Not all analysts share BofA's optimism:

- Bearish Outlooks: Many market analysts hold a more cautious, even bearish, outlook on stock market valuations, warning of the potential for a significant downturn. Their predictions deserve careful review.

- Valuation Debate: There's an ongoing debate among market analysts regarding the appropriate valuation metrics to use and the significance of current high valuations. The absence of a consensus reinforces the need for careful personal assessment.

- Diverging Opinions: The existence of widely diverging opinions underscores the inherent uncertainty in predicting market movements and the importance of independent analysis. Researching various opinions is essential.

Investing Strategies Based on BofA’s Assessment

BofA's assessment, while positive, doesn't negate the need for prudent investment strategies.

Diversification as a Key Strategy

Diversification is crucial for mitigating risk:

- Asset Allocation: Spread investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to reduce the impact of any single market downturn. This is a cornerstone of prudent investing.

- Portfolio Management: Regularly review and rebalance your portfolio to ensure it aligns with your risk tolerance and financial goals. This is crucial for long-term success.

- Risk Mitigation: Diversification is a core strategy for mitigating risk and reducing the impact of market fluctuations on your overall investment portfolio.

Long-Term Investing Approach

A long-term approach is advisable:

- Buy and Hold Strategy: Consider a "buy and hold" strategy, focusing on long-term growth rather than short-term market fluctuations. A long-term outlook helps weather market volatility.

- Market Volatility: Accept that market volatility is inevitable and that short-term declines are a normal part of the investment cycle. Don't panic sell.

- Patient Investing: A patient, long-term approach is crucial for navigating market fluctuations and achieving long-term investment success.

Conclusion: Navigating Stretched Stock Market Valuations – BofA’s Advice and Your Next Steps

BofA's assessment suggests that while stock market valuations are high, current low interest rates, strong corporate earnings, and their inflation predictions temper concerns about an immediate crash. However, potential risks associated with overvaluation and differing expert opinions highlight the need for caution. Therefore, informed decision-making is paramount. Don't let anxieties about stretched stock market valuations paralyze you. Use BofA's insights to inform your strategy, but always conduct thorough research and consult with a qualified financial advisor before making any investment decisions. Remember, effectively managing stretched stock market valuations requires a personalized approach tailored to your risk tolerance and financial goals.

Featured Posts

-

Ftc Investigates Open Ais Chat Gpt What It Means For Ai Regulation

Apr 24, 2025

Ftc Investigates Open Ais Chat Gpt What It Means For Ai Regulation

Apr 24, 2025 -

Startup Airlines Controversial Choice Deportation Flights And Their Implications

Apr 24, 2025

Startup Airlines Controversial Choice Deportation Flights And Their Implications

Apr 24, 2025 -

Inside John Travoltas 3 Million Home A Look At The Recent Photo Incident

Apr 24, 2025

Inside John Travoltas 3 Million Home A Look At The Recent Photo Incident

Apr 24, 2025 -

Chinese Stocks Listed In Hong Kong Recent Market Gains Explained

Apr 24, 2025

Chinese Stocks Listed In Hong Kong Recent Market Gains Explained

Apr 24, 2025 -

Ftc Appeals Activision Blizzard Acquisition By Microsoft

Apr 24, 2025

Ftc Appeals Activision Blizzard Acquisition By Microsoft

Apr 24, 2025