Bitcoin Price Climbs Amidst Easing Trade Tensions And Fed Concerns

Table of Contents

Easing Trade Tensions Boost Bitcoin's Appeal

Reduced trade uncertainty is creating a more positive investment climate, leading investors to explore alternative assets like Bitcoin. The lessening of trade wars, particularly between the US and China, significantly impacts global market stability. This decrease in global trade friction contributes to the appeal of Bitcoin in several key ways:

- Decreased market volatility: De-escalated trade conflicts lead to reduced market uncertainty, making Bitcoin a relatively stable haven compared to traditional markets susceptible to trade-related shocks.

- Safe haven asset status strengthened: Bitcoin's decentralized nature and independence from government control make it an increasingly attractive asset during times of geopolitical instability. Investors seek refuge in assets perceived as less vulnerable to political and economic turmoil.

- Increased investor confidence: A more predictable global trade environment boosts overall investor confidence, leading to higher demand for risk assets, including Bitcoin.

For example, the recent announcement of a partial trade agreement between the US and China directly correlated with a noticeable uptick in the Bitcoin price, demonstrating the direct link between global trade dynamics and cryptocurrency performance. This reinforces Bitcoin's position as a potential hedge against geopolitical risks.

Fed Concerns and Interest Rate Hikes Impact Bitcoin

The Federal Reserve's actions and anticipated interest rate hikes significantly influence investor sentiment towards Bitcoin and the broader financial markets. The complex relationship between monetary policy and cryptocurrency prices requires careful consideration:

- Higher interest rates potentially decrease Bitcoin's attractiveness: Increased interest rates can make traditional investments more appealing, potentially drawing investment away from riskier assets like Bitcoin. This is a classic "risk-on/risk-off" scenario.

- Inflationary pressures drive demand for Bitcoin as a store of value: If inflation rises faster than interest rates, investors may seek alternative stores of value, such as Bitcoin, to protect their purchasing power.

- US dollar strength influences Bitcoin price: A strong US dollar can sometimes negatively impact Bitcoin's price, as investors may shift funds towards the dollar, considered a safe haven currency.

Recent interest rate changes by the Fed have been observed to influence Bitcoin's price, although the correlation is not always straightforward. Experts predict further rate hikes, which may continue to impact investor sentiment and Bitcoin price analysis in the coming months. The relationship between Bitcoin price and monetary policy is a dynamic and complex one, constantly evolving as the market adapts.

Increased Institutional Adoption Fuels Bitcoin Growth

The growing involvement of institutional investors in the Bitcoin market is a significant catalyst for the recent price surge. Large-scale investments by established financial entities signal increased confidence in the long-term viability of Bitcoin:

- Growing number of institutional investors: Hedge funds, investment firms, and other institutional players are increasingly allocating a portion of their portfolios to Bitcoin.

- Potential impact of Bitcoin ETFs: The potential approval of Bitcoin exchange-traded funds (ETFs) could significantly increase market liquidity and enhance price discovery, attracting even more institutional investment.

- Increased regulatory clarity: Greater regulatory clarity in some jurisdictions is fostering higher confidence among institutional investors, reducing perceived risks.

Examples include prominent investment firms making significant Bitcoin purchases and the ongoing regulatory discussions surrounding Bitcoin ETFs, all contributing to increased institutional adoption and positive momentum for the Bitcoin price. This institutional interest is critical to the long-term stability and growth of the Bitcoin market.

Technical Analysis of Bitcoin's Price Movement

Analyzing Bitcoin's recent price performance through the lens of technical analysis provides additional insights into its potential future trajectory:

- Review of recent price charts and key technical indicators: Examining charts and indicators such as moving averages and the Relative Strength Index (RSI) helps identify existing trends and potential turning points.

- Identification of support and resistance levels: These crucial levels indicate potential price floors and ceilings, providing insights into potential future price movements and the Bitcoin forecast.

- Analysis of trading volume: High trading volume accompanying price movements confirms the strength of a trend.

By carefully examining Bitcoin charts and applying technical indicators, we can identify key support and resistance levels and gain a more informed outlook on its potential price movements. This analysis, combined with the fundamental factors discussed earlier, provides a comprehensive approach to understanding and predicting Bitcoin price trends. However, it's crucial to remember that technical analysis offers predictions, not guarantees.

Conclusion

The recent Bitcoin price climb is a result of a complex interplay between easing trade tensions, concerns surrounding the Federal Reserve’s monetary policy, and the growing adoption of Bitcoin by institutional investors. These factors are interconnected and influence each other, contributing to the overall upward momentum. The increased institutional investment, coupled with the potential for reduced geopolitical risk, has created a positive environment for Bitcoin’s price.

The Bitcoin price climb presents a compelling opportunity to explore the world of cryptocurrency. Learn more about Bitcoin investment strategies and stay informed about the latest market developments to capitalize on potential future price movements. Stay updated on the latest Bitcoin price fluctuations and consider diversifying your investment portfolio with this dynamic asset. Remember to conduct thorough research and consider your risk tolerance before making any investment decisions.

Featured Posts

-

The Bold And The Beautiful Two Weeks Of Drama Hope Liam Steffy And Luna

Apr 24, 2025

The Bold And The Beautiful Two Weeks Of Drama Hope Liam Steffy And Luna

Apr 24, 2025 -

The Zuckerberg Trump Dynamic How The Next Presidency Impacts Facebook

Apr 24, 2025

The Zuckerberg Trump Dynamic How The Next Presidency Impacts Facebook

Apr 24, 2025 -

Landlords Accused Of Exploiting La Fire Victims Selling Sunset Star Weighs In

Apr 24, 2025

Landlords Accused Of Exploiting La Fire Victims Selling Sunset Star Weighs In

Apr 24, 2025 -

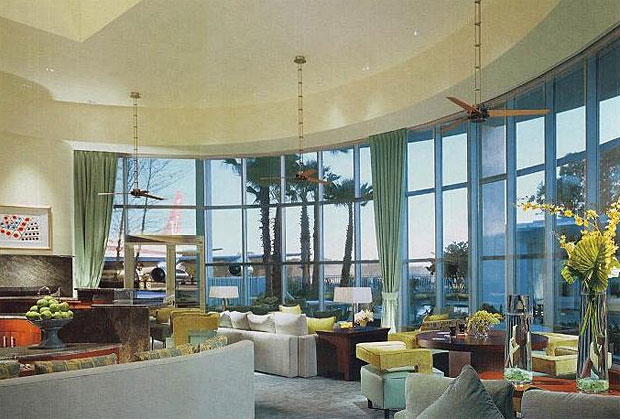

Inside John Travoltas 3 Million Home A Look At The Recent Photo Incident

Apr 24, 2025

Inside John Travoltas 3 Million Home A Look At The Recent Photo Incident

Apr 24, 2025 -

The Paradox Of Pope Francis Global Reach Internal Divisions

Apr 24, 2025

The Paradox Of Pope Francis Global Reach Internal Divisions

Apr 24, 2025