Assessing The Liberals' Fiscal Record: A Path Towards Responsible Spending In Canada

Table of Contents

Government Spending Under the Liberals

The Liberal government's approach to spending has been characterized by increased investment in social programs and infrastructure. Understanding this spending pattern is crucial for evaluating the Liberals' fiscal record.

Increased Social Program Spending

The Liberals have significantly increased spending on several key social programs. This commitment to bolstering the Canadian social safety net, while laudable to some, has raised questions about fiscal sustainability.

- Increased Healthcare Spending: Significant increases in transfer payments to provinces for healthcare, aiming to improve access and reduce wait times. Data from the Department of Finance Canada reveals a substantial increase in healthcare spending since 2015, although the effectiveness of these investments in achieving improved health outcomes remains a subject of ongoing debate.

- Enhanced Education Funding: Investments in post-secondary education, aiming to increase access and affordability. While these initiatives have been welcomed by students and educators, the long-term fiscal implications need careful consideration. Statistics Canada provides detailed data on education spending and its impact on various demographics.

- Expanded Social Benefits: Expansion of existing social programs and the introduction of new initiatives, such as the Canada Child Benefit. This policy has had demonstrable effects on poverty reduction for families, but its overall cost and long-term implications on the budget necessitate continuous review.

Infrastructure Investments

The Liberal government has made substantial investments in infrastructure projects across the country, aiming to stimulate economic growth and create jobs.

- Major Infrastructure Projects: The Pan-Canadian Framework on Clean Growth and Climate Change, alongside various provincial and municipal initiatives, has seen billions invested in roads, bridges, public transit, and other critical infrastructure. These projects have generated employment in various sectors and aimed to improve overall infrastructure efficiency.

- Economic Impact Assessments: While infrastructure investment generally boosts economic activity, independent assessments are required to accurately measure long-term economic returns. These evaluations should consider factors such as project completion times, cost overruns, and the overall multiplier effect on jobs and economic activity. Data from Infrastructure Canada provides an overview of planned and completed projects.

- Funding Sources and Sustainability: These substantial investments rely heavily on increased government borrowing, adding to the national debt. The long-term sustainability of this approach depends on economic growth exceeding the cost of servicing this debt.

Debt Accumulation and Deficit Management

The Liberals' increased spending has led to a significant rise in the national debt and deficit. Assessing this aspect is pivotal when examining the Liberals' fiscal record.

- National Debt Increase: The national debt has steadily risen under the Liberal government, fueled by increased spending and lower-than-projected revenue in some years. The Bank of Canada provides regular updates on key economic indicators, including the national debt.

- Comparison to Previous Governments: Comparisons to the fiscal performance of previous governments are essential to provide context. Analysis should factor in differing economic circumstances and policy priorities.

- Government Strategies for Debt Reduction: The government's plans for debt reduction, if any, need careful scrutiny. Evaluating the feasibility and effectiveness of these strategies is essential for assessing fiscal responsibility.

Revenue Generation Strategies of the Liberal Government

Analyzing the government's revenue generation strategies is essential for understanding the overall fiscal picture.

Taxation Policies

The Liberal government has implemented various tax policies, aiming to increase revenue and redistribute wealth.

- Changes to Corporate Tax Rates: The Liberal government lowered the federal corporate tax rate, a move aimed at boosting business investment and economic growth. The impact on corporate profitability and government revenue is a subject of ongoing discussion among economists.

- Personal Income Tax Changes: Adjustments to personal income tax brackets have affected different income groups differently. Analyzing the distributional effects of these changes is crucial for evaluating their overall impact on equity and fiscal sustainability.

- Impact on Tax Revenue: The net effect of these tax policies on overall government revenue needs to be rigorously evaluated and compared to initial projections.

Economic Growth Under Liberal Leadership

Economic growth is a critical factor influencing government revenue and overall fiscal health.

- GDP Growth Figures: Analyzing GDP growth rates under the Liberal government and comparing them to previous periods and other developed countries provides crucial context. Statistics Canada provides regularly updated GDP figures.

- Job Creation Statistics: Job creation rates are an important indicator of economic health and the government's success in stimulating the economy. These numbers provide a valuable metric to evaluate economic impact.

- Inflation Rates: Inflation rates and their impact on purchasing power and government spending need careful consideration in any assessment of fiscal performance.

Assessing Fiscal Responsibility and Future Directions

A thorough assessment of the Liberals' fiscal record requires examining long-term sustainability and proposing improvements.

Evaluating Fiscal Sustainability

Long-term projections of debt and deficit are essential to determine the sustainability of current fiscal policies.

- Long-Term Projections: Independent analysis of long-term projections is needed to identify potential risks and challenges associated with the current fiscal trajectory. The Parliamentary Budget Officer's reports provide valuable insights.

- Potential Risks and Challenges: Identifying potential future economic shocks and their potential impact on fiscal sustainability is crucial. This involves considering both internal and external economic forces.

Recommendations for Responsible Spending

Improving the Liberals' fiscal approach requires concrete policy recommendations.

- Specific Policy Recommendations: Focusing on spending efficiency, streamlining government operations, and prioritizing essential public services are areas for immediate attention.

- Potential Trade-offs and Challenges: Implementing these recommendations necessitates careful consideration of potential trade-offs and political challenges. Balancing fiscal prudence with social priorities demands a thorough approach.

Conclusion

The Liberals' fiscal record presents a complex picture. While increased investment in social programs and infrastructure has addressed pressing needs, the significant rise in national debt raises concerns about long-term fiscal sustainability. A balanced approach is needed, combining social investments with sound fiscal management and rigorous cost-benefit analyses. Understanding the intricacies of the Liberals' fiscal record is crucial for informed participation in Canadian political discourse. Continue the conversation by researching further into the Department of Finance Canada's website and engaging in discussions about the path towards responsible fiscal policy in Canada. A focus on responsible budgeting, and strategies to decrease the national debt, is critical for ensuring Canada's long-term economic prosperity.

Featured Posts

-

Trumps Budget Cuts Increase Tornado Season Risks Experts Warn

Apr 24, 2025

Trumps Budget Cuts Increase Tornado Season Risks Experts Warn

Apr 24, 2025 -

Harvard Lawsuit Trump Administration Signals Potential Negotiation

Apr 24, 2025

Harvard Lawsuit Trump Administration Signals Potential Negotiation

Apr 24, 2025 -

Death Of Sophie Nyweide Child Star Of Mammoth And Noah At 24

Apr 24, 2025

Death Of Sophie Nyweide Child Star Of Mammoth And Noah At 24

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 16 Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025

The Bold And The Beautiful Wednesday April 16 Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025 -

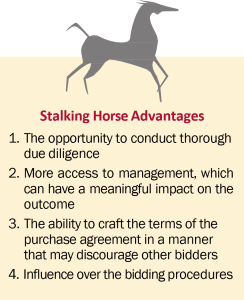

Village Roadshow Sale Alcons Stalking Horse Bid Wins At 417 5 Million

Apr 24, 2025

Village Roadshow Sale Alcons Stalking Horse Bid Wins At 417 5 Million

Apr 24, 2025