Ackman's View: Time Favors The US In Trade Conflict With China

Table of Contents

Ackman's Underlying Assumptions: A Strong US Economy and Technological Advantage

Ackman's bullish stance likely rests on a fundamental belief in the enduring strength of the US economy and its technological leadership. He probably assesses the US as possessing a superior capacity for innovation, particularly in crucial sectors like semiconductors and artificial intelligence. This technological edge, he might argue, represents a significant long-term competitive advantage against China. The resilience of the US economy, even amidst global headwinds, further strengthens this argument.

- US dominance in key technological sectors: The US boasts a significant lead in the development and production of advanced semiconductors, crucial for numerous industries. Its dominance in AI research and development further solidifies its position.

- Resilience of the US economy despite global headwinds: The US economy has shown considerable adaptability and recovery capability throughout various economic downturns and global crises.

- Long-term growth potential of the US: Continued innovation, a skilled workforce, and a robust financial system underpin the US's potential for sustained long-term growth.

- China's reliance on foreign technology and investment: China's ambition to become a technological superpower is hampered by its continued dependence on foreign technologies and intellectual property, creating vulnerabilities.

Keywords: US economic strength, technological advantage, innovation, semiconductor industry, artificial intelligence, economic resilience.

The Time Factor: Strategic Patience and Long-Term Gains

A core element of Ackman's perspective is likely the emphasis on strategic patience. He probably believes the US can leverage its strengths over the long term to gain a decisive competitive edge. This "long game" approach acknowledges short-term challenges but focuses on the ultimate outcome. China's vulnerabilities, particularly its dependence on exports and its susceptibility to internal and external economic shocks, are likely key factors in Ackman's analysis.

- China's vulnerability to supply chain disruptions: The current global supply chain fragility exposes China's dependence on external factors.

- Long-term consequences of China's debt levels: China's high debt levels create significant long-term economic risks.

- The potential for domestic unrest in China affecting stability: Internal political and social pressures could disrupt China's economic trajectory.

- The strategic importance of alliances for the US: The US's strong network of international alliances provides significant geopolitical leverage.

Keywords: long-term investment strategy, strategic patience, China's vulnerabilities, supply chain resilience, economic stability.

Deterring China: The Role of US Policy and Alliances

Ackman likely recognizes the crucial role of US government policy in shaping the trade conflict with China. He might view proactive trade policies, strategic alliances, and coordinated responses as key elements in countering China's economic actions. The effectiveness of sanctions and other trade restrictions, coupled with the potential for future trade agreements and negotiations, further contribute to his optimistic outlook.

- US trade policies and their impact on China: Targeted trade policies aim to level the playing field and protect US interests.

- The role of international alliances in countering China's influence: Cooperation with allies amplifies the impact of US policy.

- The effectiveness of sanctions and other trade restrictions: Strategic sanctions can weaken China's economic leverage.

- The potential for future trade agreements and negotiations: Future trade agreements could further solidify the US's position.

Keywords: US foreign policy, international alliances, trade agreements, sanctions, geopolitical strategy, China's economic influence.

Investment Implications: Opportunities Arising from the Trade Conflict

From an investment perspective, Ackman would likely identify several opportunities arising from the US-China trade conflict. He probably sees substantial investment potential in sectors benefiting from the decoupling of the two economies, particularly in the US and other strategically aligned nations.

- Investment opportunities in US technology companies: Companies at the forefront of innovation in key sectors are expected to thrive.

- Sectors benefiting from reshoring and nearshoring initiatives: Companies bringing manufacturing and production closer to home will benefit from reduced reliance on China.

- Emerging markets gaining from shifting global trade patterns: Some emerging markets might experience significant growth as global trade patterns shift.

- Potential risks and diversification strategies: Investors should consider diversification to mitigate potential risks.

Keywords: investment opportunities, US stock market, emerging markets, diversification, portfolio management, reshoring, nearshoring.

Conclusion: A Long-Term Perspective on US-China Trade Relations

Ackman's central argument highlights the long-term advantages for the US in the trade conflict with China. His optimistic view rests on the pillars of US economic strength, technological leadership, and strategic advantages amplified by effective policy and alliances. The potential investment implications are significant, offering opportunities for substantial long-term growth in specific sectors. To fully understand the implications of this complex geopolitical and economic scenario, further research into Ackman's investment strategies is encouraged. Consider how Ackman's view on US-China trade might inform your own investment decisions and strategic planning. Keywords: investment strategy, long-term outlook, US economic future, China's economic challenges, US-China trade relations.

Featured Posts

-

Opinion Evaluating The Credibility Of The Cdcs Latest Vaccine Study Team Member

Apr 27, 2025

Opinion Evaluating The Credibility Of The Cdcs Latest Vaccine Study Team Member

Apr 27, 2025 -

Supporting Canadian Businesses Napoleon Ceos Focus

Apr 27, 2025

Supporting Canadian Businesses Napoleon Ceos Focus

Apr 27, 2025 -

Ideas For A Happy Day February 20 2025

Apr 27, 2025

Ideas For A Happy Day February 20 2025

Apr 27, 2025 -

Alberto Ardila Olivares Y Su Garantia De Anotacion Tecnica Y Estrategia

Apr 27, 2025

Alberto Ardila Olivares Y Su Garantia De Anotacion Tecnica Y Estrategia

Apr 27, 2025 -

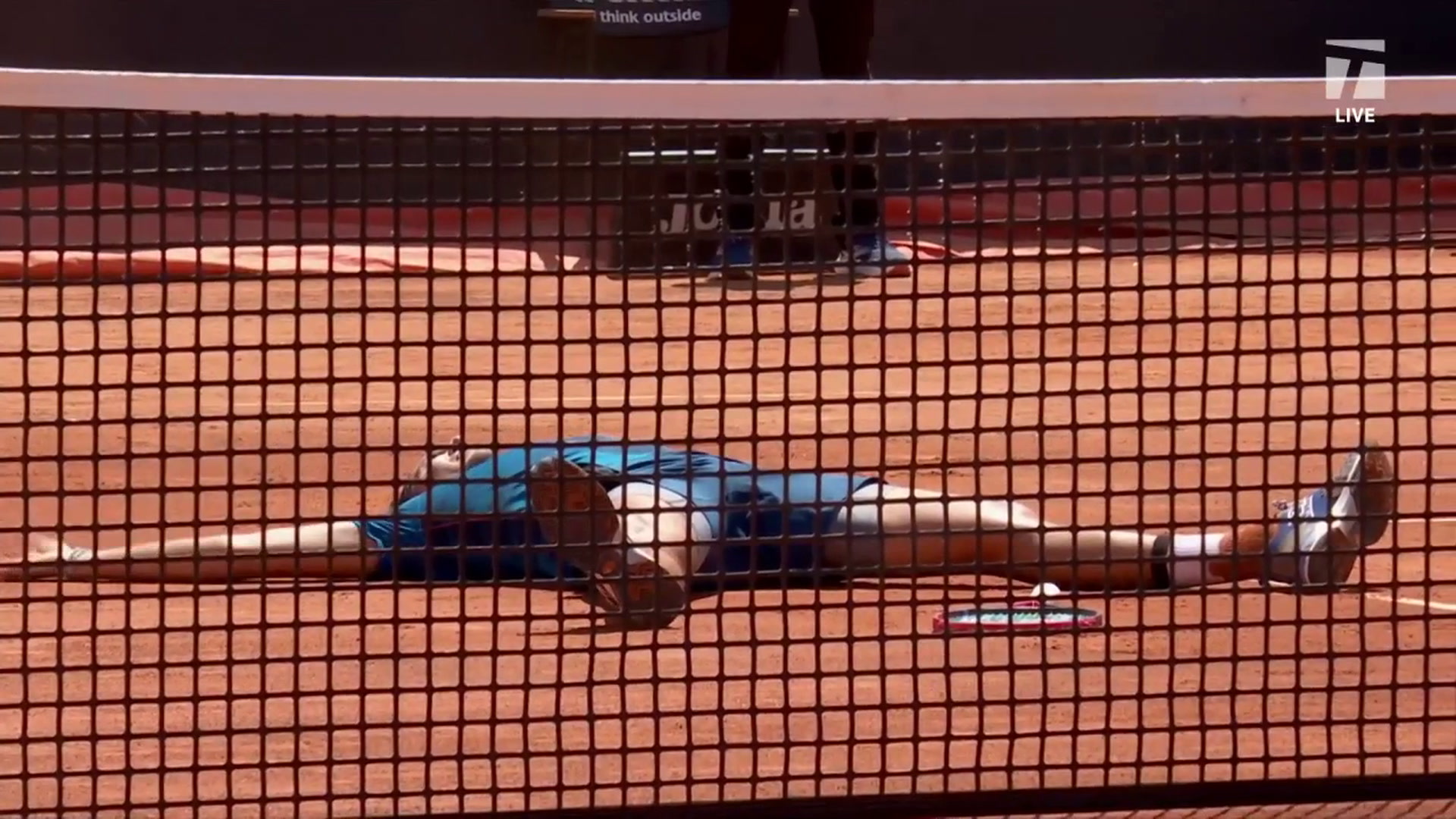

Novak Djokovics Upset Loss To Alejandro Tabilo At Monte Carlo Masters 2025

Apr 27, 2025

Novak Djokovics Upset Loss To Alejandro Tabilo At Monte Carlo Masters 2025

Apr 27, 2025