A More Responsible Canada: Rethinking Fiscal Policy Under The Liberals

Table of Contents

Government Spending and Debt Management

Analysis of Recent Budgets

The Liberal government's approach to fiscal policy has involved significant increases in government spending across various sectors. Analyzing recent budgets reveals a trend of increased investment in social programs, such as Canada Child Benefit and social housing initiatives, alongside substantial infrastructure projects.

- Increased Spending: Significant investments have been made in social programs, aiming to reduce poverty and inequality. For example, the Canada Child Benefit has provided substantial financial support to families with children. Furthermore, investments in affordable housing have been earmarked, though the long-term impact remains to be fully assessed.

- Infrastructure Investment: Billions have been allocated to infrastructure projects across the country, focusing on public transit, roads, bridges, and broadband internet access. While this boosts economic activity in the short term, careful evaluation of long-term benefits and cost-effectiveness is crucial.

- Rising National Debt: This increased spending has contributed to a rising national debt. While the government argues that this is a necessary investment for future growth, concerns remain regarding the long-term sustainability of the current trajectory. The debt-to-GDP ratio needs to be closely monitored for potential risks.

Relevant statistics and data regarding government spending and debt levels (sourced from reliable government publications like the Department of Finance Canada) should be included here to support these points.

Evaluating Debt Sustainability

The long-term implications of Canada's increasing national debt require careful consideration. While low interest rates currently mitigate the immediate burden, rising interest rates could significantly increase debt servicing costs.

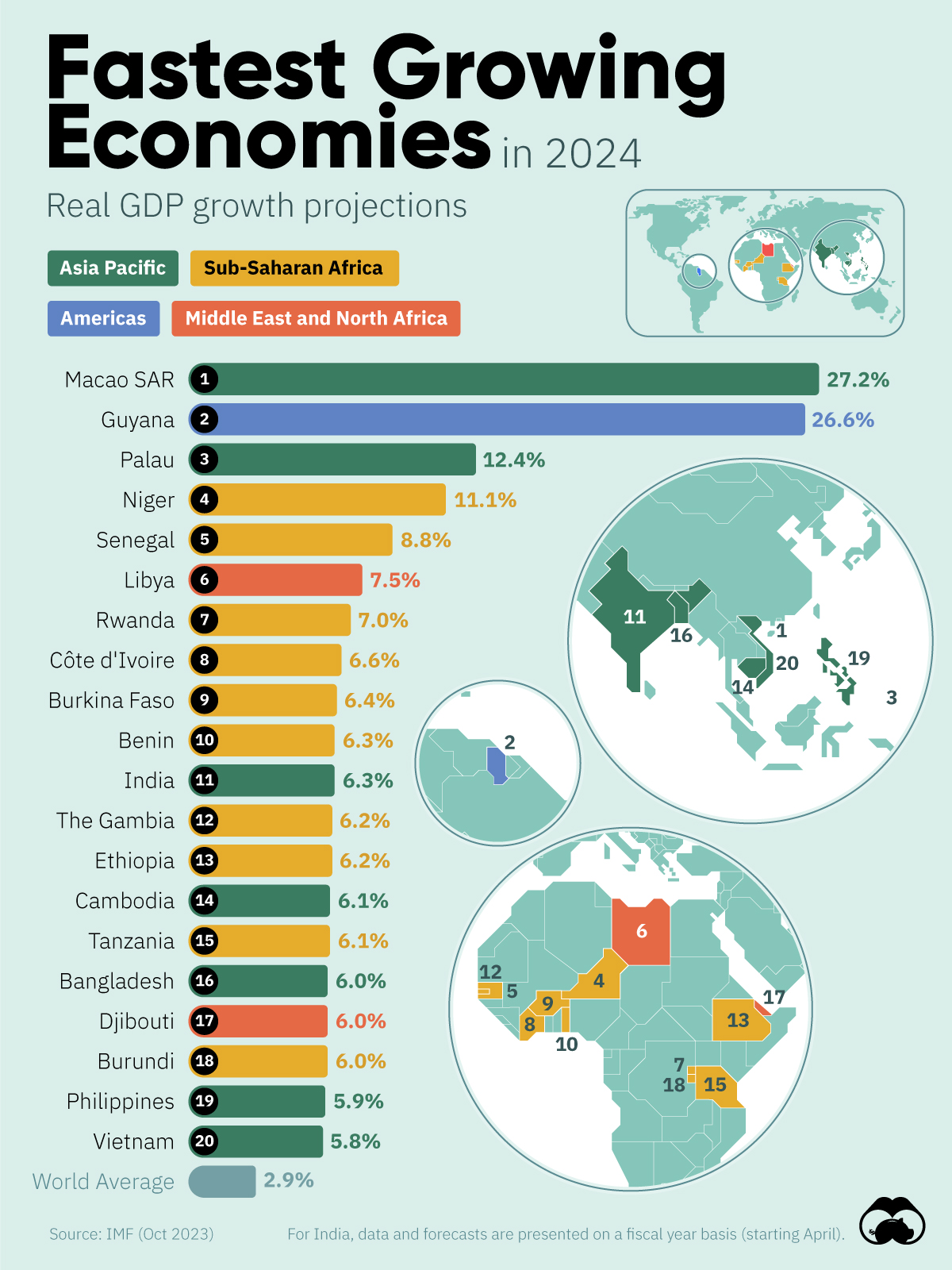

- International Comparisons: Comparing Canada's debt-to-GDP ratio to other developed nations provides valuable context. Are we significantly higher or lower than comparable economies, and what are the implications of this?

- Debt Reduction Strategies: Strategies for debt reduction include controlling spending growth, exploring options for increased tax revenues, and fostering economic growth to increase the GDP denominator in the debt-to-GDP ratio. A balanced approach is necessary, avoiding drastic cuts that negatively impact essential services.

- Impact of Economic Growth: Sustained economic growth is crucial for managing debt. Policies that encourage business investment, job creation, and innovation are paramount to increase tax revenues and bolster the economy.

Taxation Policies and Their Impact

Analysis of Current Tax Policies

Canada's tax system comprises various income taxes, corporate taxes, and indirect taxes. Understanding their effectiveness is crucial for evaluating the overall fiscal policy.

- Income Tax Brackets: The current income tax brackets determine the distribution of tax burdens across different income groups. Analyzing the progressivity of the system is key to evaluating its fairness and potential for revenue generation.

- Corporate Tax Rates: Corporate tax rates significantly impact business investment and job creation. High rates might discourage investment, leading to slower economic growth, while excessively low rates might reduce government revenue. Finding the optimal balance is vital for long-term economic health.

- Indirect Taxes: The Goods and Services Tax (GST) and Harmonized Sales Tax (HST) are significant revenue generators. Analyzing their impact on consumer spending and their potential for reform (e.g., adjusting rates or broadening/narrowing the tax base) is essential.

Potential for Tax Reform

Tax reform is a continuous discussion point in Canadian politics. Improving fairness, efficiency, and revenue generation are key goals.

- Progressive vs. Regressive Taxation: The debate between progressive (higher earners pay a larger percentage) and regressive (lower earners pay a larger percentage) taxation systems significantly influences income inequality and overall economic welfare. A thorough examination is needed.

- Tax Incentives: Targeted tax incentives can stimulate investment in specific sectors. However, careful evaluation is needed to ensure that these incentives are effective and don't lead to unintended consequences or undue favoritism.

- Tax Avoidance and Evasion: Addressing tax avoidance and evasion is essential for maximizing government revenue and maintaining public trust. Strengthening enforcement mechanisms and simplifying the tax system are key components of this.

Infrastructure Investment and Economic Growth

Infrastructure Spending and its Effectiveness

Government investment in infrastructure is essential for long-term economic growth. However, assessing its effectiveness requires careful analysis.

- Successful Infrastructure Projects: Highlighting successful projects and their economic benefits (e.g., improved transportation networks leading to reduced logistics costs, increased tourism) illustrates the positive impact of strategic investment.

- Challenges in Infrastructure Development: Addressing challenges such as cost overruns, delays, and procurement issues is crucial for improving efficiency and maximizing the return on investment. Better project management and transparent procurement processes are needed.

- Long-Term Economic Benefits: Infrastructure projects often yield long-term benefits, which need to be carefully factored into the cost-benefit analysis. This includes benefits beyond immediate job creation, such as improved productivity and quality of life.

Strategic Infrastructure Planning

Strategic planning is crucial to optimize infrastructure investment and maximize its economic impact.

- Public-Private Partnerships (P3s): Evaluating the effectiveness of P3s in delivering infrastructure projects, considering both their advantages (risk sharing, expertise) and disadvantages (potential cost overruns and disputes), is crucial.

- Technological Advancements: Incorporating technological advancements in infrastructure development (e.g., smart city technologies, automation in construction) can improve efficiency, reduce costs, and enhance sustainability.

- Environmental Considerations: Integrating environmental considerations into infrastructure planning is essential for long-term sustainability and mitigating environmental impacts. This includes focusing on green technologies and sustainable materials.

Conclusion

This analysis of fiscal policy in Canada under the Liberals reveals the complex interplay between government spending, taxation, and debt management. A responsible approach necessitates a comprehensive evaluation of current policies and their long-term implications. While infrastructure investment is crucial for economic growth, effective debt management and a fair, efficient tax system are equally vital. Moving forward, a continued and deeper examination of Canada's fiscal policy is needed to ensure sustainable economic growth and a more prosperous future for all Canadians. Let's continue the conversation about building a more responsible and sustainable future through thoughtful discussion and informed policy-making regarding fiscal policy in Canada and its various components.

Featured Posts

-

The Crucial Role Of Middle Management Benefits For Companies And Employees

Apr 24, 2025

The Crucial Role Of Middle Management Benefits For Companies And Employees

Apr 24, 2025 -

Mark Zuckerbergs Facebook In The Trump Era Challenges And Opportunities

Apr 24, 2025

Mark Zuckerbergs Facebook In The Trump Era Challenges And Opportunities

Apr 24, 2025 -

Bmw And Porsches China Challenges A Growing Trend In The Auto Industry

Apr 24, 2025

Bmw And Porsches China Challenges A Growing Trend In The Auto Industry

Apr 24, 2025 -

Bold And Beautiful Liam And Steffys Future Hopes Dilemma And Lunas Interference

Apr 24, 2025

Bold And Beautiful Liam And Steffys Future Hopes Dilemma And Lunas Interference

Apr 24, 2025 -

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 24, 2025

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 24, 2025