5 Key Do's & Don'ts: Succeeding In The Private Credit Job Market

Table of Contents

Do: Network Strategically within the Private Credit Industry

Networking is paramount in the private credit industry. Building strong relationships can open doors to unadvertised opportunities and provide invaluable insights.

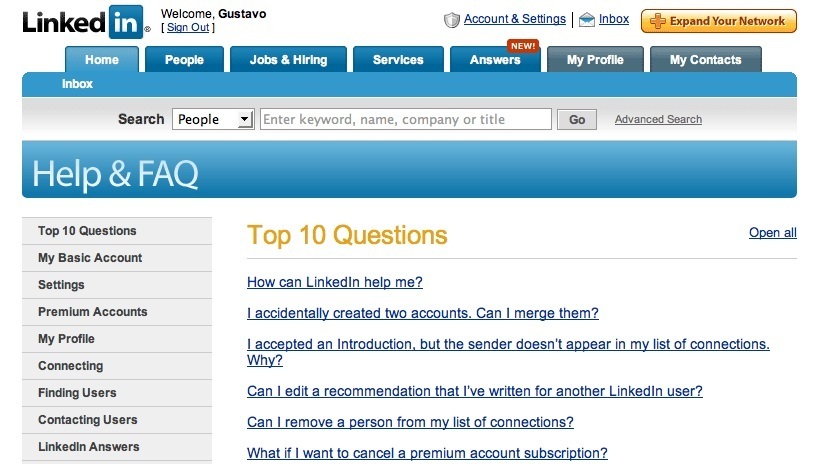

Leverage LinkedIn Effectively

Your LinkedIn profile is your digital resume. Optimize it with relevant keywords like "private credit," "private debt," "alternative lending," and "financial modeling."

- Optimize your profile for keywords: Use industry-specific terminology throughout your profile summary, experience section, and skills section.

- Connect with recruiters and professionals: Actively seek connections with recruiters specializing in finance jobs and individuals working in private credit firms.

- Participate in discussions: Engage in relevant groups and discussions to showcase your expertise and network with industry leaders.

- Share insightful articles: Share relevant articles and content to establish yourself as a thought leader in the private credit space.

Attend Industry Events and Conferences

Industry events are invaluable networking opportunities. They allow you to meet professionals, learn about new trends, and explore potential job openings.

- Research relevant events: Identify conferences, workshops, and networking events focused on private credit, alternative lending, or broader finance topics.

- Prepare talking points: Develop concise and engaging talking points highlighting your skills and experience relevant to private credit.

- Follow up with contacts after the event: Send personalized emails to individuals you connected with, reinforcing your interest and sharing additional relevant information.

Informational Interviews

Informational interviews provide invaluable insights into specific roles and companies. They help you understand the day-to-day realities of a private credit job and build relationships with professionals.

- Research potential contacts: Identify professionals working in roles and companies that interest you.

- Prepare thoughtful questions: Develop insightful questions about their career path, the company culture, and the current private credit market.

- Express gratitude for their time: Always thank the individual for their time and consideration.

Don't: Neglect Your Financial Modeling Skills

Strong financial modeling skills are non-negotiable for success in private credit. Proficiency in financial modeling and data analysis is crucial for deal structuring and investment analysis.

Master Excel and Financial Modeling Software

Proficiency in Excel and specialized financial modeling software is critical. Familiarity with Argus, Bloomberg Terminal, and other industry-standard tools is highly valued.

- Practice building complex financial models: Focus on building models that accurately reflect the complexities of private credit transactions.

- Focus on accuracy and efficiency: Develop your skills in building models quickly and accurately.

- Showcase your skills in your resume and cover letter: Highlight your proficiency in financial modeling software and your ability to handle complex financial data.

Underestimate the Importance of Data Analysis

The ability to interpret financial statements, market trends, and analyze large datasets is essential for identifying promising investment opportunities.

- Develop proficiency in data analysis techniques: Master techniques like regression analysis, statistical modeling, and data visualization.

- Highlight relevant projects on your resume: Showcase projects where you've used data analysis to inform investment decisions or solve business problems.

Neglect Continuing Education

The private credit landscape is constantly evolving. Keeping your skills and knowledge current is vital for staying competitive.

- Consider relevant certifications: Explore certifications like the Chartered Financial Analyst (CFA) designation or other relevant credentials.

- Pursue advanced degrees: Consider pursuing a Master's degree in Finance or a related field.

- Attend industry workshops: Stay updated on market trends and best practices by attending relevant workshops and seminars.

Do: Tailor Your Resume and Cover Letter to Each Application

Generic applications rarely succeed in a competitive market. Each application should be carefully tailored to the specific job description and company.

Highlight Relevant Skills and Experience

Your resume should clearly showcase the skills and experiences that are most relevant to the specific job description.

- Use keywords from the job description: Incorporate keywords from the job posting directly into your resume and cover letter.

- Quantify your achievements: Use numbers and metrics to demonstrate the impact of your contributions in previous roles.

- Focus on results: Highlight the positive outcomes and achievements you delivered in previous roles.

Showcase Your Understanding of the Private Credit Landscape

Demonstrate your understanding of the private credit market, its nuances, and its key players.

- Research companies thoroughly: Understand the company's investment strategy, recent deals, and overall market positioning.

- Demonstrate knowledge of current market trends: Show awareness of current market conditions and regulatory changes.

- Highlight relevant industry knowledge: Display your understanding of key concepts and terminology within the private credit sector.

Don't: Undersell Your Achievements and Strengths

Don't be afraid to highlight your accomplishments and showcase your unique strengths. Quantify your achievements and negotiate confidently.

Quantify Your Accomplishments

Use the STAR method (Situation, Task, Action, Result) to showcase your accomplishments and highlight your impact.

- Use the STAR method: Clearly describe the situation, task, actions you took, and the quantifiable results you achieved.

Be Afraid to Negotiate

Negotiating salary and benefits is crucial. Know your worth and be confident in advocating for yourself.

- Research salary ranges: Use online resources to research salary ranges for similar roles in your location.

- Prepare a salary range expectation: Develop a realistic salary range based on your research and experience.

- Be confident and assertive during negotiations: Clearly articulate your value and your salary expectations.

Do: Prepare for Behavioral and Technical Interviews

Thorough preparation is essential for acing both behavioral and technical interviews.

Practice Common Interview Questions

Private credit interviews often include technical questions about financial modeling and credit analysis, and behavioral questions assessing your personality and work style.

- Practice answering behavioral questions using the STAR method: Structure your answers using the STAR method to provide clear and concise responses.

- Prepare for technical questions related to financial modeling and credit analysis: Be ready to explain your approach to financial modeling, credit risk assessment, and deal structuring.

Research the Interviewers and the Firm

Thorough research demonstrates genuine interest and helps you ask insightful questions.

- Learn about the firm’s investment strategy: Understand their investment focus, target asset classes, and overall investment philosophy.

- Learn about recent deals: Research the firm's recent investments and transactions to demonstrate your understanding of their activities.

- Learn about the interviewer's background: Research the interviewer’s background and experience to establish common ground and tailor your responses.

Conclusion

Succeeding in the private credit job market requires a strategic approach. By focusing on strategic networking, mastering crucial financial modeling skills, tailoring applications effectively, confidently showcasing your achievements, and thoroughly preparing for interviews, you significantly increase your chances of securing your dream role. Start implementing these tips today to boost your success in the private credit job market! Ready to take your private credit career to the next level? Put these do's and don'ts into action now!

Featured Posts

-

60 Minutes Executive Producers Resignation Independence Concerns Following Trump Legal Action

Apr 24, 2025

60 Minutes Executive Producers Resignation Independence Concerns Following Trump Legal Action

Apr 24, 2025 -

Epa Crackdown On Tesla And Space X Elon Musks Doge Response

Apr 24, 2025

Epa Crackdown On Tesla And Space X Elon Musks Doge Response

Apr 24, 2025 -

Dow Rallies 1000 Points Stock Market Update And Live Analysis

Apr 24, 2025

Dow Rallies 1000 Points Stock Market Update And Live Analysis

Apr 24, 2025 -

Fbi Hacker Made Millions From Compromised Executive Office365 Accounts

Apr 24, 2025

Fbi Hacker Made Millions From Compromised Executive Office365 Accounts

Apr 24, 2025 -

Anchor Brewings Closure 127 Years Of Brewing History Ends

Apr 24, 2025

Anchor Brewings Closure 127 Years Of Brewing History Ends

Apr 24, 2025